The outlook for 2016 looks steady

The outlook for 2016 looks steady

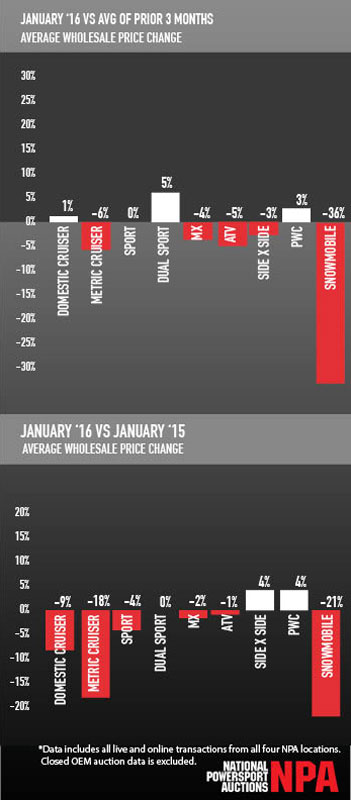

[dropcap]J[/dropcap]anuary’s Average Wholesale Pricing (AWP) mirrored December’s performance. Compared to the prior 3-month average, prices were flat for all street categories except for metric cruisers, which declined due to product mix. Off-road categories were down slightly from the prior 3-month average and were roughly even with last year. Compared to last year, street categories softened in January, which could be partly due to the weather in the east, given that wholesale prices appeared stronger in the west during the same timeframe.

When compared to NADA Clean Wholesale values, wholesale price/book was almost identical to last year. We expect that trend to continue, with 2016 price/book ratios mirroring 2015. The overall product mix by vehicle category remained stable in January, with domestic cruiser volume as the dominant category followed by sport bikes, metric cruisers, ATVs and other off-road products. There is potential for domestic cruiser volume to increase in the spring, but we expect the mix to remain comparable to 2015.

Overall vehicle model age in January is starting off older than last January, with a combined average of approximately 6.3 years old. Metric cruisers tend to have the oldest average model age and off-road the least. We don’t expect the average age in 2016 to grow much beyond the current averages on a seasonally adjusted basis.

Total auction volumes were down slightly from December, while bidder activity and buyer interest remained solid indicating strong pre-owned demand. Domestic cruisers had the most inventory views overall, while off-road had the most views per unit available. January’s viewing interest is the highest we’ve seen to date and supports the idea that a healthy pre-owned spring season is on the horizon.

In general, we expect 2016 to mirror 2015 both at the auction and retail levels. Consumer interest is solid, new models are driving growth and lending remains relatively inexpensive. Auction pricing and volumes should remain stable with no notable increases over last year. Pre-owned demand should remain strong and new sales will grow incrementally where innovation and price point best align with what consumers are looking for.