Right on track for this time of year

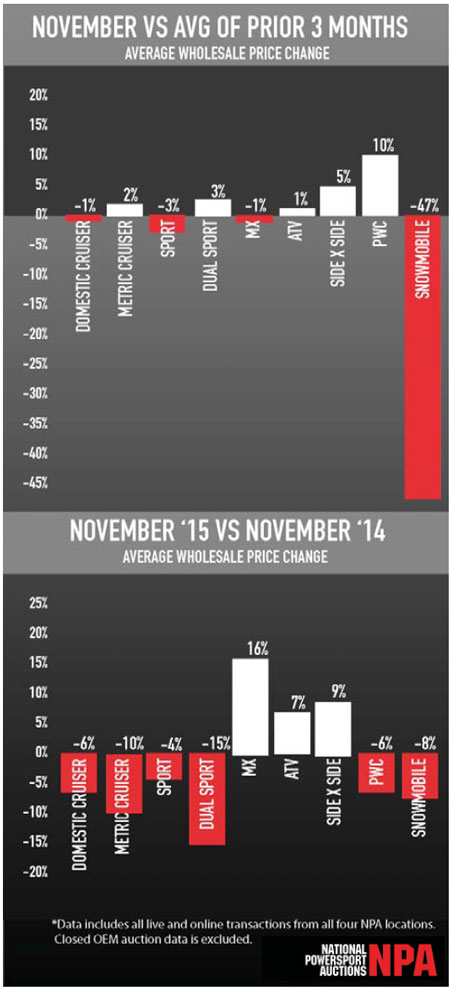

November Average Wholesale Pricing (AWP) remained stable overall with some variance by vehicle category. Compared to the prior 3-month average most categories were stable, with a notable AWP increase in side-by-sides due to a more expensive product mix as well as a drop in snowmobile AWP due to a liquidation of older units. When compared to prior year’s AWP values, street categories remained lower due to a higher average model age and off-road product AWP rose.

November Average Wholesale Pricing (AWP) remained stable overall with some variance by vehicle category. Compared to the prior 3-month average most categories were stable, with a notable AWP increase in side-by-sides due to a more expensive product mix as well as a drop in snowmobile AWP due to a liquidation of older units. When compared to prior year’s AWP values, street categories remained lower due to a higher average model age and off-road product AWP rose.

Activity and pricing in the auction lanes felt stronger in November than the numbers suggest, reflecting an emerging appetite for dealers beginning to stock for the spring selling season. The average condition of units sold remained fairly static and seasonality behavior for the month was generally consistent with prior years. When compared to the most recent NADA Clean Wholesale values, wholesale pricing trends remained stable and generally in-line with seasonal averages, reinforcing the fact that November AWP fluctuations tended to be due to product mix more than demand.

Product mix by product category reversed course slightly in November as domestic cruiser volume took a back seat to a rise in metric cruiser and ATV volume. The potential for domestic cruiser dealers to be influenced by OEM incentives to liquidate more pre-owned inventory has had limited impact so far on auction volume and pricing. Overall wholesale volume sold rose slightly from the prior month, consistent with seasonal norms as dealers liquidate excess year-end inventory while other dealers stock up for spring.

Overall, the wholesale market is performing as expected for this time of year. Consistent with the latest economic forecasts from the MIC’s recent Communication Symposium, this suggests dealers currently expect spring retail sales to be equal to or better than 2015. We anticipate typical wholesale trends to continue into spring as the riding season returns. t