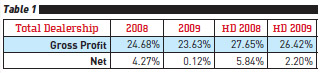

The following compares the year-end 2008 and 2009 National Norms data compiled and averaged from multiple GSA groups. We have included the H-D National Norms as well.

In Table 1 we see just how tough this year has been for both metric and H-D dealers. That said, H-D dealers still hold much better profits than metric dealers.

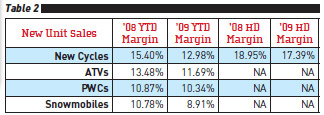

Table 2 shows why H-D dealers are pulling more profit: better new-unit margins. Also, although not shown, they are now pulling used margins similar to the metric dealers. This has not always been the case in the past.

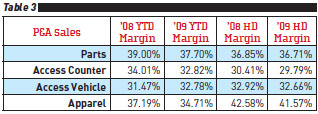

P&A sales margins are mostly higher for metric dealers with the exception of apparel. The H-D apparel permits both higher volume and margins based on the strength of their branding.

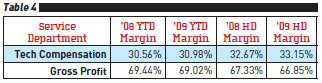

As we have stated in the past, the goal for service is to hold tech compensation (not including benefits) to 30% of revenue in order to achieve the 70% gross profit necessary to pay the bills. Metric dealers did a slightly better job here.

Use this information to see what you can improve in your dealership operation. Get a handle on every aspect of your business. Measure, monitor and manage it so you will be around when this thing finally runs its course.

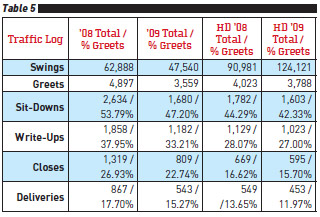

Moving on, the traffic log data in Table 5 reveals the huge difference in floor traffic between metric and H-D dealers. It should be noted that there are significantly fewer H-D dealers. However, metric dealers do a much better job of closing the deals.

Please use this data to help you in the coming year. Our goal is to provide you with the road signs to guide you. It is vital that you begin to track these numbers so you can take control of them. Survivors are proactive, not reactive.

Maximize Every Sale With F&I and PG&A

This recorded AIMExpo education track discusses how the bike is just the start of the sale.

At AIMExpo 2024, Greg Jones, content director for MPN, moderated the finance and insurance (F&I) panel in MPN's Dealer Excellence education track. The panel consisted of Jason Duncan, McGraw Powersports; JD Baker, Protective Asset Protection; John McFarland, Lightspeed; and Zachary Materne, Apiar Commercial Risk Management.

In this session, Jones and the panel discuss how to maximize every sale beyond the bike with F&I and parts, gear and accessories (PG&A). The panel advises on best practices, how to make the purchase process more exciting, how to utilize technology in this process and more.

Elevating Your Sales Game Through Parts Packaging

Breaking down the art and science of a well-designed, customer-focused, profit-friendly parts package.

Unleash Your Experts: How to Be a Long-Tail Resource for Powersports Enthusiasts

Closing deals and providing service are a dealer’s bread and butter, but your dealership has far more to offer.

Building a Growth Stategy With a Powersports Playbook

Success isn’t a fluke, and it’s not luck. It’s a strategy.

Fostering an F&I Culture That Sells

Dealership success hinges on the ability to cultivate a strong F&I culture.

Other Posts

Increasing Profits Through Accessorizing

Go out and find the units to dress up — there’s lots of extra profit to be made.

AJ Meisel Creates Community at Plano Kawasaki Suzuki

AJ has learned a thing or two over her 30-year powersports career.

Q&A: Powersports Consumer Sentiment Forecast for 2024

Consumers aren’t delaying purchases because of the economy, but they’re still looking for deals.

Nothing But Good Vibes at Santa Barbara Motorsports

Santa Barbara Motorsports is working to make every door swing count.