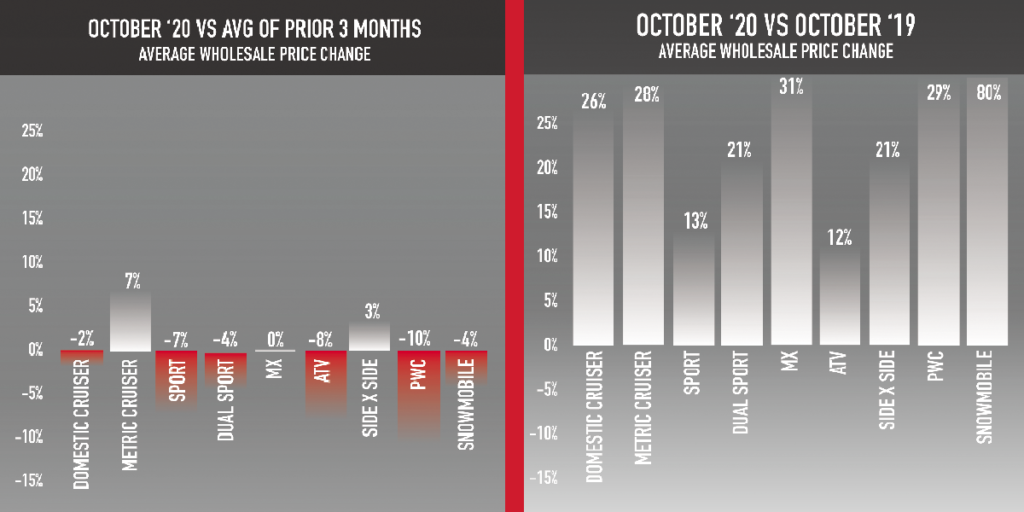

Pricing Changes Direction

October was the first month since spring where we have seen a majority of the powersport categories Average Wholesale Price (AWP) drop below the prior three-month average. This drop usually takes place between June and

July, but due to consumer demand, the drop held off until October.

Demand was not the only reason AWP changed.

Average condition in many categories dropped in October vs. prior months. Metric cruisers and side-by-sides were the only two categories that AWP increased over the prior three-month average. One of the main reasons the metric cruiser AWP increased was because the average mileage dropped to a three-month low.

The MX, side-by-side and ATV categories all experienced a drop in average condition report (CR) score vs. prior months. The drop in CR was the main driver of their AWP decreases. Model age amongst these units has not fluctuated significantly.

Demand for the Right Product

As overall values begin to show seasonal declines, clean condition and low mileage vehicles continue to bring top dollar at auction. We expect this trend to continue throughout the year as the “right” supply is still hard to come by.

Looking Ahead

October’s downshift in values was due to both product condition and some softening of dealer demand as the season winds down. Dealers continue to tell us retail sales are at an all-time high and product, especially used product, is next to impossible to find.

NPA will be holding it’s first live auction in Lakeland, Florida, in November. This is NPA’s first location in Florida and will provide additional insight into an already mature market. We will be able to share more information on the Florida market next month.

All data provided by National Powersport Auctions includes live and online transactions from all NPA locations. Closed OEM auction data is excluded.

Link: NPA