Déjà vu is defined as “a feeling of having already experienced the present situation.” This is an apt description for Average Wholesale Prices (AWP) in January as 2017 got underway.

Markets in the West started slow in San Diego and Dallas, then picked up steam in Cincinnati and Atlanta as the month progressed.

This is the same start we’ve seen in AWP the prior two years, so 2017 is off to a “normal” start. A notable exception was the mid-month wholesale prices in our first-ever Philadelphia auction, which were several points stronger than the rest of the month and a great reflection of the enthusiasm we had hoped for in the Northeast. Overall, wholesale prices were on par to slightly up from December.

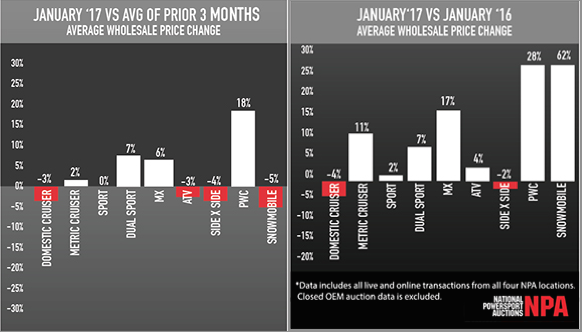

Street categories were mixed when compared to the prior 3-month average. Metric Cruisers were up 2%, Domestic Cruisers were down 3% and Sport bikes were flat. Off-Road prices were mixed as well – ATVs were down 3-4% from the prior 3-month average while MX bikes were up 6%. Year-over-year, every product category was up over January 2016 except for Domestic Cruisers, which were down 4%, and SxSs which were down 2%.

For Domestic Cruisers, product mix by model family was similar to both last month and the prior year. Average model age grew for the more expensive Touring and Softail families, which helped to drag down the AWP for Domestic Cruisers overall. Some market softness existed as well for those product categories, contributing to the drag on AWP. We have yet to see any notable effects from either the introduction of the Milwaukee-Eight or Polaris’ decision to discontinue the Victory brand.

It is too early to predict exactly what will happen with wholesale prices in 2017, especially with atypical weather patterns, a new president, and the loss of the familiar Victory brand. However, we have every reason to expect another well-behaved year given stable financing trends, fresh new models coming to market, healthy pre-owned sales, and growing dealer sophistication about managing pre-owned inventory. Even a slight uptick in consumer confidence and discretionary spending would bring a welcome boost to the powersports market and ensuing price trends.

All data provided by National Powersport Auctions. For more information, please visit www.npauctions.com