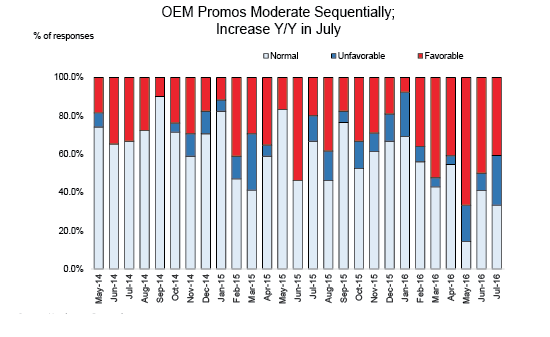

[dropcap]O[/dropcap]ur latest survey of powersports dealers indicates that retail sales for dealers remained soft in July. The most commonly cited reason for the softer year-over-year sales results was a reduction in OEM promotional support sequentially, as well as tough comps in the ATV market.

[dropcap]O[/dropcap]ur latest survey of powersports dealers indicates that retail sales for dealers remained soft in July. The most commonly cited reason for the softer year-over-year sales results was a reduction in OEM promotional support sequentially, as well as tough comps in the ATV market.

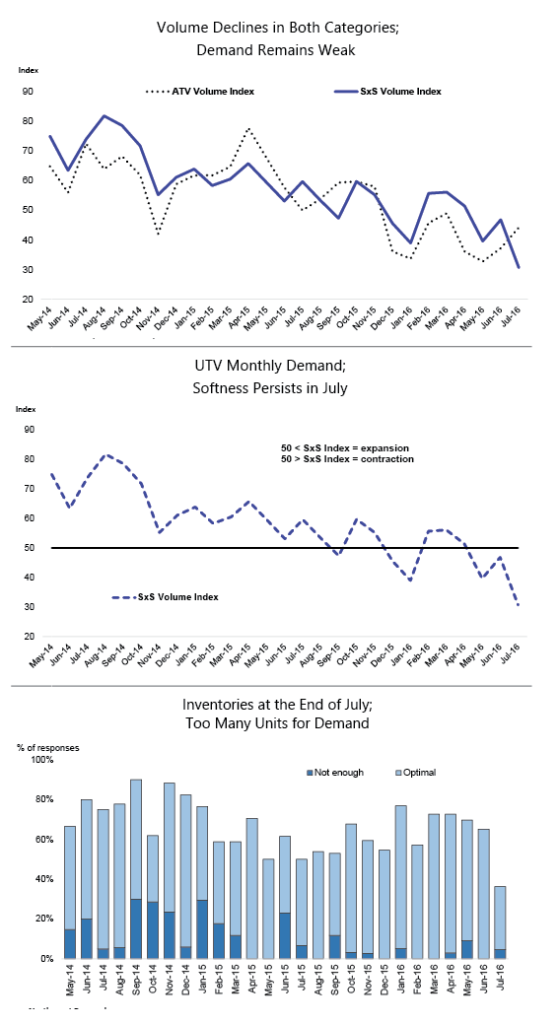

As a result, dealers finished the month with too much inventory for how they saw demand trending but felt that the incentives associated with new model rollovers would likely be able to improve their inventory position relative to how they see demand trending but believe this dynamic could improve as Polaris’ yearly Factory Authorized Clearance sale started at the end of the month, and other manufacturers have similar year end promotions to help dealers’ clean inventory before receiving the 2017 models.

Furthermore, there was incremental chatter that consumers are opting for lower price point units when possible, and secondary brands like CFMOTO, Husqvarna, HiSUN and KYMCO are receiving more interest from consumers. In short, the market continues to be very volatile and consumers are skittish – especially on the high-ticket products.

Furthermore, there was incremental chatter that consumers are opting for lower price point units when possible, and secondary brands like CFMOTO, Husqvarna, HiSUN and KYMCO are receiving more interest from consumers. In short, the market continues to be very volatile and consumers are skittish – especially on the high-ticket products.

It will be interesting to see how consumers react to the influx of new products hitting the market later in the quarter.

For a complete copy of Seth’s research this month, download the PDF at http://bit.ly/2ca4IaQ