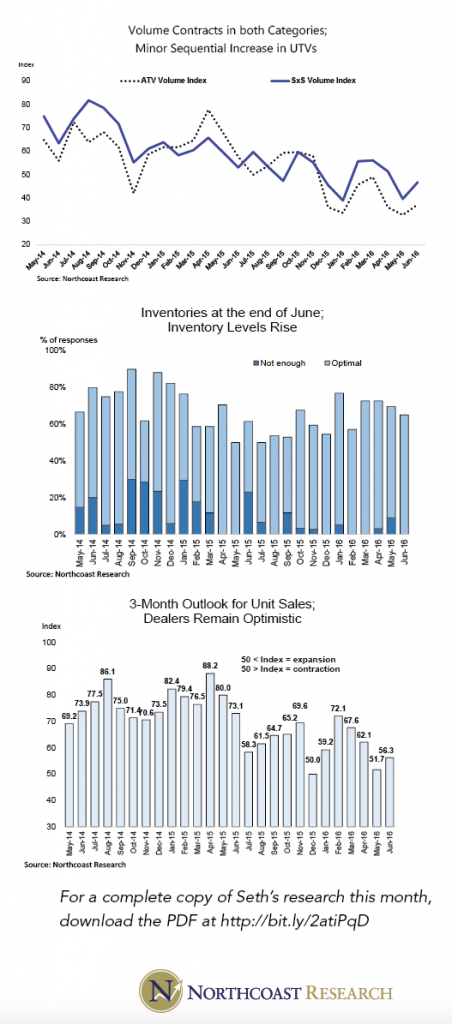

[dropcap]O[/dropcap]ur latest survey of powersports dealers indicate that the ORV retail sales environment improved modestly in the month of June, but remained challenged. Indeed, our measure of demand for both traditional ATVs and SxS vehicles was weak during the month.

[dropcap]O[/dropcap]ur latest survey of powersports dealers indicate that the ORV retail sales environment improved modestly in the month of June, but remained challenged. Indeed, our measure of demand for both traditional ATVs and SxS vehicles was weak during the month.

The negative themes that have plagued the industry since the latter half of 2015 continued to be present in our conversations with most dealers last month. Specifically, the continuous sales pressure throughout the oil patch, which is a deterioration that Polaris called out in its recent earnings conference call (down ~20%). In our view, the impact of a fickle (read: volatile), price-sensitive consumer and elevated inventory levels amidst the backdrop of uncertainty that presidential elections seem to bring is helping to feed one of the most intensely promotional environments that we have ever seen. In our opinion, this is something that will continue until dealers inventories better match end-market demand, which is clearly not the case right now as dealers inventory levels (relative to demand) are rising to a level that has not been seen since 4Q15. Luckily most OEMs are taking steps to address the inventory issues, which should lead to improving profitability.

On the motorcycle side of things, motorcycle dealers saw weakness re-emerge in 2Q16 after ending the first quarter on a high note. In our last column, we questioned whether the weakness in 2Q was a function of optics related to a weather pull-forward of sales into March or weak consumer spending. Three months in, we appear to have the answer: end-market demand in the motorcycle industry is weak right now. Indeed, after the aforementioned sluggish start of April, many dealers actually reported seeing weaker trends in the month of May. And while sales trends improved somewhat in June, it appears that dealers only saw a moderation of the weakness and were still posting y/y unit declines. Right now, OEMs seem to be losing sales to the used market where prices are struggling to find a floor. In fact, we have been surprised by the fact that even the used HD Rushmore bikes hitting the pre-owned market are not having the expected cushioning effect many expected. Until next time.

Seth Woolf, a research analyst with Northcoast Research Partners, covers the powersports sector within his consumer sector coverage list. Northcoast Research Partners is an institutional equity research firm located in Cleveland, Ohio.