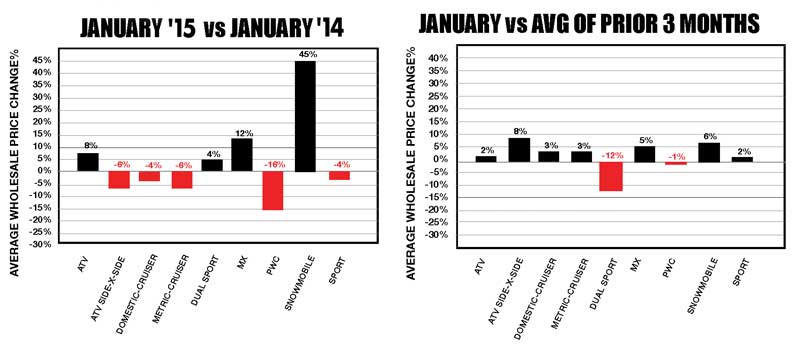

Average wholesale pricing (AWP) started off 2015 on a softer note than usual. Dealers report optimism mixed with a “wait and see” attitude for spring 2015. Pricing will undoubtedly rise as spring unfolds, but could be below prior years if the retail season is softer than expected. January domestic cruiser average sales price (ASP) rose and is on par with December, which saw a heathy rise. Metric cruisers (especially large displacement) started off below last year and sport bikes were on par with prior years.

Off-road vehicles were up over December and the prior year. Participation has been strong and dealers projected greater confidence in the lanes than in prior months, so spring pricing should exhibit fairly normal characteristics. The ratio of domestic cruisers leveled off again in January and the percentage of metric street bikes rose while ATVs declined.

Wholesale volumes sold in January were below 2014 levels as both the units offered and conversion rates declined. This is partly due to repo volumes being cleared out at the end of the year and some dealers holding back consignment units in hopes of better pricing in February, which may or may not actually materialize. Dealer auction purchases through Internet channels (e.g., NPA eSale, NPA Simulcast, etc.) remain the preferred acquisition method, with a slight decline in units purchased via Simulcast.

Vehicle model age and condition in January remained similar to December, with sold units being slightly older and in about the same condition as the prior quarter and prior year. Demand as reflected in vehicle views vs. inventory rose in January, suggesting increasing interest in vehicles in most categories as dealers look ahead to spring.

MSRP for most 2014 models appears to be notably higher than prior model years, especially H-D and Side-by-Side products. It is too early to tell if this will produce higher ASP at auction when those units comprise a sufficiently greater share of the mix.