This article contains actual numbers obtained from our 20-group data reporting and analysis system. 20-groups consist of dealers from non-competing markets who meet three times a year to share financial and best practice information. Their goal is to grow and improve their businesses profitably.

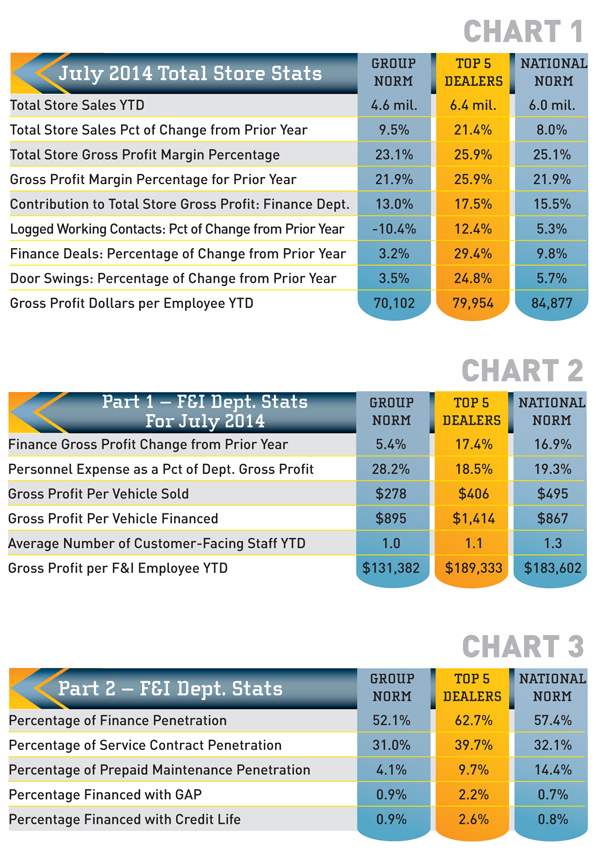

As you can see from the Total Store stats, sales are up – slightly – for the group and National Norm dealers, but significantly for the group’s Top 5. Although the group didn’t hit the benchmark target of 25 percent, margins look considerably better for them and the National Norm dealers.

Are you among the dealers who say, “I can’t afford an F&I person?” Think very seriously about the 15-17 percent contribution that F&I could make to your gross profit. Do the math.

Financed deals made a big jump for the Top 5. Getting the financing opens the door to a lot more income for your store. It’s not just the opportunity to add-on F&I products; your add-on P&A sales are affected by your ability to capture their financing in house.

Note that the National Norm average for gross profit dollars per employee is actually higher than that of the Top 5 members of this particular group. Where do you stand? It’s not that hard to calculate.

It’s always good to see an increase in gross profit over the previous year. We like to see personnel expenses under 20 percent – the group is a bit high in this area. In the previous paragraph I mentioned the importance of capturing the financing in relation to dealership profits.

Take a look at the comparison in gross profit per vehicle sold vs. gross profit per vehicle financed. That tells the whole story. I find it interesting that the Top 5 are slightly lower in dollars per vehicle sold compared to the National Norm, but they are killing it in dollars per vehicle financed at $1,400 a copy. That is excellent.

The last two lines should speak volumes about why you need a well-trained F&I person. If you don’t have one, you need to ask yourself this question. Could your dealership have benefitted from an extra $100,000 + in gross profit over seven months? Overall, dealers average around one person in this department…but that person produces a phenomenal amount of gross profit dollars.

I love seeing the finance penetration numbers consistently above the 50 percent mark. The Top 5 are nearing 63 percent! They are also selling almost 40 percent service contracts. That is good in today’s world of extended warranty “freebies” from many of the OEs.

Prepaid maintenance (we prefer calling them Preferred or VIP programs) is working its way back up – particularly for the National Norm dealers. This is an excellent way to tie your customers to your store. Keep their service business and you have a much better chance of getting their next unit sale.

GAP sales are profitable and benefit many people who are buying high-dollar bikes and UTVs. If you haven’t gone after this business, you should look into it. If it requires an insurance license in your state, get one.

Making money with F&I is not (forgive me) rocket science. Hire a talented F&I producer, provide them with ongoing training, acquire every F&I product you can sell, offer them to EVERY purchaser, EVERY time. Those are the basic rules for making it happen in your F&I department.

Steve Jones, GSA senior projects manager, recaps critical measurements used by the leading 20-group dealers. Access to GSA’s Voyager 5 data analysis & comparison system is available for any dealership for a nominal fee. For more information on Voyager, management workshops, dealer 20-groups, on-site consulting or training, send an email to [email protected] or visit www.gartsutton.com.