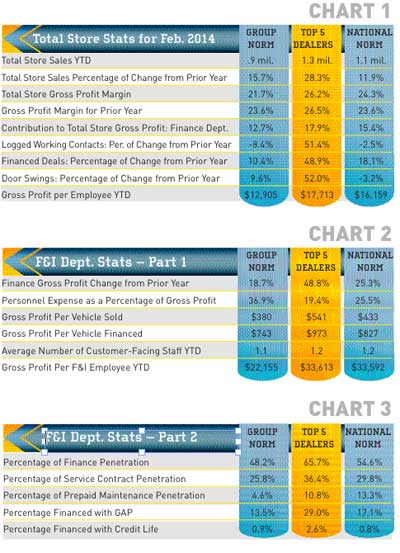

Although February does not give us much depth for the data, we still get an early peek at what the market has been doing this winter. Total store sales were up across the board and margins came up almost 2 points for this group (Chart 1). The Top Five dealers are just above that benchmark number of 25 percent.

The percent of change for logged contacts came up a bunch for the Top Five, as did their financed deals and door swings. Notice the relationship in the growth figures for all three numbers. They not only got them in the door, but their staff did an excellent job of taking care of them once they entered the store.

Gross Profit for the finance department was up for all the dealer categories – almost 50 percent for the Top Five. Hmm, that is similar to the increases we noted for the overall dealership numbers. In addition, they are holding down their personnel expenses.

The key numbers here are Per Vehicle Sold (PVS) and Per Vehicle Financed (PVF) as shown in Chart 2. You can compare these with any size dealership, large or small. What generally makes the big difference between the dealers with the big numbers and those with so-so numbers is a combination of two things: 1) A dealership culture that supports the benefits of F&I products, and 2) Well-trained F&I producers. The last part is an absolute necessity. F&I can be a huge profit center, but there is a lot of regulatory compliance involved. Mess up here and the penalties can be painful. Lesson: Don’t scrimp on training for your F&I staff.

The large percentage of finance penetration (Chart 3) shows that all the dealers have good lending sources. However, the Top Five dealers have done a great job of securing multiple lenders – they can get a larger percentage of their deals completed in-house. This can result in additional sales of P&A as well as F&I products.

Service contract penetration is continuing to climb back up since the recession, but it is well below the heyday of 60-70 percent. This is largely due to the number of longer warranty programs being offered by the OEs. That said, it is still a good product for many purchasers and can be very profitable for you.

GAP is another product that has been undersold. As long as we have big-ticket items with large drops in value following the first ride, GAP is very saleable. This is particularly true of many of the models that have become a target for theft. Although I didn’t include the numbers in this chart, I would suggest looking into selling some of the various security system products out there. Some dealers have done quite well with theft-deterrent and/or recovery products.

Overall, these results suggest that we might be off to a good start for the new year. I hope you all have a highly-successful and profitable 2014.

If you have questions about the article, or if I can provide you with assistance, shoot an email to [email protected]. For information on our upcoming management workshops or on-site dealer assistance, check out our website at www.gartsutton.com.

Steve Jones, GSA senior projects manager, outlines dealership best business practices to boost margins, increase profitability and retain employees. His monthly column recaps critical measurements used by the leading 20-group dealers. Access to GSA’s new Voyager 5 data reporting and analysis system is available for any dealership for nominal fee. For more information on our data reporting system, management workshops, dealer 20-groups, on-site consulting or training, visit www.gartsutton.com.