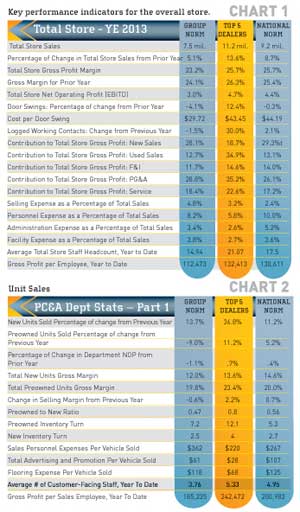

All-in-all, 2013 was a decent year. You can see from Chart 1 that total store sales were up, as was Net Operating Profit (NOP) – albeit slightly. Overall store margins slipped a small amount for the group and the Top 5, but increased slightly for the National Norm (NN) dealers. The Top 5 continue to do a better job of getting people in the door and capturing their information for less cost than the norm. There is a reluctance to advertise, but it is a necessity. The key is to put the money in the right places with sufficient frequency. It takes more exposure now to get a response than it used to because of the increase in media bombardment.

Chart 2 – Unit sales are up across the board with the exception of the drop in used sales by the group. This is doubly bad because this is where the gross profit is. You can see the result in their NOP. Gross profit pays the bills, folks. Check out the relationship of number of turns to flooring and advertising expenses for the Top 5. Volume decreases the expenses per vehicle sold. They are not only better at getting people in the door, they are better at closing them.

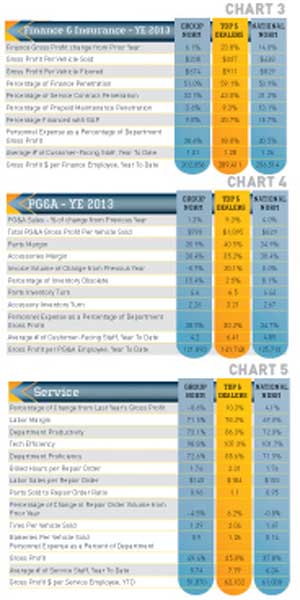

Chart 3 – F&I went up nicely for 2013. This has been helped by the improved financing situation with banks and credit unions. That said, the members of the group could use some help. The group norm is weak and even the Top 5 in the group are being pounded in per vehicle sold by the overall NN dealers. The results we see in dealers who attend an F&I training session make all these numbers look pretty anemic.

Chart 4 – PG&A sales were up with decent gross profit per vehicle sold and reasonable parts margins. The accessories margins for the group and the NN dealers could use some work. Very soon we will be able to break this out by clothing and accessories. Then we can make a better determination of how to improve this situation. The sticking point has been getting all the dealers to set up accurate dealer management system categories so they can accurately track these numbers. You should be doing this as well. Note that the Top 5 averaged about two more employees in this department and they sold around $20K more per person than the group or NN dealers. If you do the math, they had almost $300,000 more gross profit than the NN dealers. Think about this for a minute. Right people, right training.

Chart 5 – Service was interesting. While the NN and Top 5 dealers improved in gross profit, the group went down. The Top 5 were beating the goal of two hours per repair order and parts to labor ratio, but the NN and group dealers are still lagging. This is a key element in increasing service profits and it is largely attributable to the service advisor. These folks have an important position. You need an adequate staff with proper training. You want them to have less than 200 repair orders per month so they can properly conduct a walk-around and up-sell with the customers.

Tire and battery sales are health indicators. Dealers who sell more tires than units are generally stealing this business from other dealers. So what? If you have a decent service advisor, you are getting a lot of add-on sales with every tire change. If you can capture their tire business, you have a chance to capture their service business and that can lead to more unit sales. It all works together.

Conclusion: The upward trend for our business is continuing – slow, but steady. This bodes well if we keep our expenses in line and provide the exceptional customer experience that ensures we keep them as customers. Your people make the difference. Hire the right staff and provide ongoing training. It pays off.

In April, GSA will be conducting a 3-day workshop called “5 Profit Centers.” The workshop covers the basics of 5 profit center accounting, personnel management, best practices and vital benchmarks for all departments. See www.gartsutton.com for further details.

Steve Jones, GSA senior projects manager, outlines dealership best business practices to boost margins, increase profitability and retain employees. His monthly column recaps critical measurements used by the leading 20-group dealers.