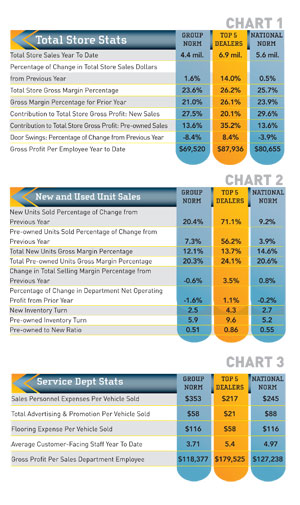

We’ll be comparing July data from a good-performing metric 20-group with the National Norm (NN) numbers and the averages for the Top 5 dealers for this group in each category.

We’ll be comparing July data from a good-performing metric 20-group with the National Norm (NN) numbers and the averages for the Top 5 dealers for this group in each category.

This is looking better than earlier in the year. Total store sales started off slow this year but have rebounded — the improvement over last year is not huge, but it is positive. Gross margins for this group and the NN dealers are up nicely, although the group is still below the 25 percent target (check out the contribution to total store gross profit coming from pre-owned sales for the Top 5 dealers). The Top 5 are still growing floor traffic (door swings), but at a slower pace than in the past. The group and NN dealers are down slightly.

The NN dealers are really improving their gross profit per employee — this is very significant. In order to do this, you have to have the right people with the attitude and aptitude to do the job. These folks must then be provided with high-quality, ongoing training. Take this as a cue to examine your operations.

Chart 2 shows increases in new and pre-owned unit sales across the board. The Top 5 are rockin’ and rollin’ in this area. New unit margins are decreasing — probably because of inventory pressure. Everyone is getting on board with the pre-owned margins. Note that the Top 5 are holding 24 percent!

Net operating profit is flat. New turns are still low for NN and group dealers. However, the flooring costs have been dropping, which tells me they are doing a better job of controlling the inventory levels. Top 5 dealers are getting almost 10 turns from their pre-owned — and at 24 points! That’s why the pre-owned contribution to total store gross profit is so large. All of these dealers are over the .5 to 1 ratio (One used sold for every two new). The best dealers sell two or more pre-owned for every new unit sold because of the profitability involved.

Another profit maker is controlling the sales costs per vehicle sold. NN dealers are improving here as well, but the group is lagging behind. That shows up in the gross profit per employee as well. Top 5 dealers are spending less per unit but still increasing floor traffic. Perhaps they are working the shows and events harder, more frequently or both? As I stated earlier, flooring costs are down. That may be due to better flooring support programs as much as inventory control.

I encourage you to do more than just read this article. Use these numbers — compare them with your dealership’s performance. Identify the weak areas so you can make improvements.

Steve Jones, GSA senior projects manager, outlines dealerships’ best business practices to boost margins, increase profitability and retain employees. His monthly column recaps critical measurements used by the leading 20-group dealers. Access to the new Voyager 5 data reporting and analysis system is available to any dealership for nominal fee. For more information on GSA’s management workshops, data

reporting system, dealer 20-groups, on-site consulting or training, send Steve an email at [email protected] or visit www.gart-sutton.com.