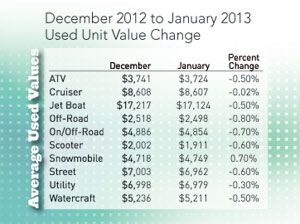

As Black Book completed the data analysis within the motorcycles and powersports products, we found the market remains largely unchanged once again this month. There is not a single segment that has changed in value by even one full percentage point. Here are the individual segment changes:

- ATVs, jet boats and personal watercraft are all down by .5 percent.Street bikes and scooters are down by .6 percent, while off-road bikes are down .8 percent.

- Dual-sport bikes are down .7 percent, while utility vehicles are down a mere .3 percent.

- Snowmobiles are up .7 percent, but at this time of year increases of 3 percent to 5 percent would be more typical.

For the most interesting segment this month, cruisers are showing no change at all with a net adjustment of zero percent, though in dollar figures they are down by an average of $4 per unit. Though it is not reflected in the overall averages for the segment, there are two distinct trends among the cruisers. First, the metric units are all down by around half a percent just like the rest of the street bikes, but the domestic V-Twins are up by about half a percent.

For the most interesting segment this month, cruisers are showing no change at all with a net adjustment of zero percent, though in dollar figures they are down by an average of $4 per unit. Though it is not reflected in the overall averages for the segment, there are two distinct trends among the cruisers. First, the metric units are all down by around half a percent just like the rest of the street bikes, but the domestic V-Twins are up by about half a percent.

This is the second month in a row that we have seen a little bit of relative pricing strength for these domestic V-Twin units. Normally, the small amount of the change would not be noteworthy, but with the rest of the market stagnating, the domestic V-Twins are definitely some of the strongest performers right now. Keep in mind that Bike Week in Florida is not that far into the future, which might be driving the domestic V-Twin’s current strength.