At GSA we track current industry benchmark data through our real-time dealer 20-group data reporting analysis and comparison system. This month, we are going to look at actual October data compiled from one of our groups.

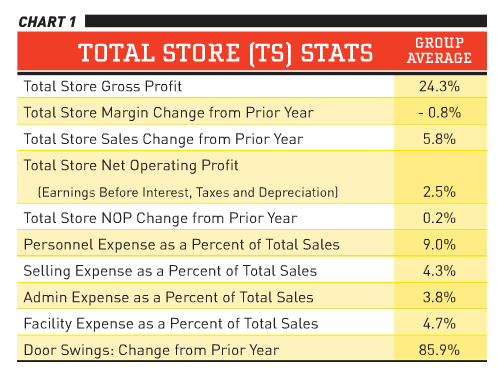

The total store stats shown in Chart 1 show that gross profit for this group is hovering close to the target benchmark of 25 percent. The TBOC (or top performers) number is only a tenth better at 24.4 percent. More significantly, total store sales are up almost 6 percent from last year, door swings are up 86 percent and the net operating profit is up as well. However, their total expenses are still well above the target of 20 percent. The name of the game is controlling expenses. This is the shortest route to increasing profitability.

That being said, you still have to ensure you have adequate staff to provide quality customer experience, and you don’t always have a lot of control over facility costs. Control what you can as best as you can; review every expense carefully to determine if it is really necessary. Small expenses can really add up.

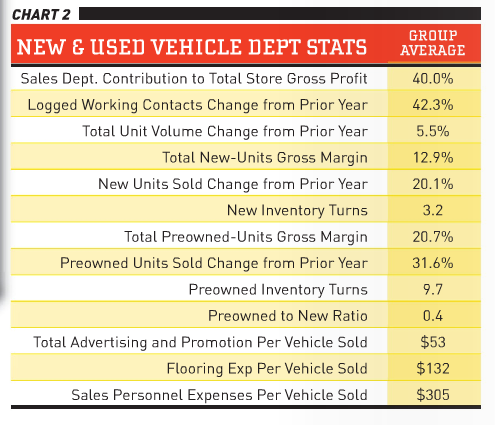

In Chart 2 we see that the working contacts have continued to grow. This is a really good sign when combined with the increase in door swings. More important is the fact that it resulted in increased sales.

The new unit margin could use some work. The TBOC number is 13.4 percent. This is still not fabulous, but it is better than most dealers reported over the last two years as they tried to eliminate excess inventory. Preowned is still the hot profit center in unit sales.

Speaking of preowned, notice the 32 percent increase in sales, the 9.7 turns in inventory and the 20.7 percent margin. Are you seeing results like this in your store? You are trying to build this part of your business, aren’t you? If you have the funds or flooring available, winter is an excellent time to acquire good used units for next spring.

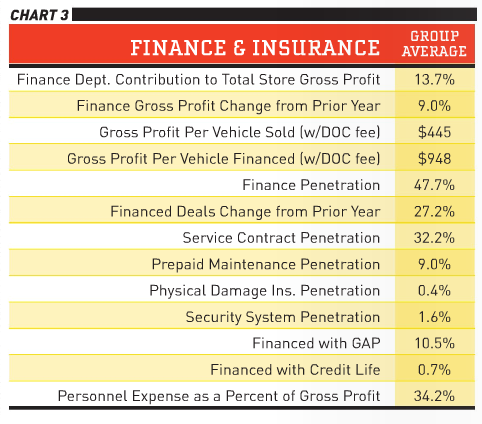

Chart 3 shows that F&I profits are increasing as well. Gross profit per vehicle sold in August was $307; now it is $445. If you do not have a strong, well-trained F&I person, think about what you are missing. Could you use an extra $445 average gross profit for every unit you sold? Gross profit per vehicle financed was $677; now it has grown to $948. These dealers are getting more units financed – up 27 percent. This is the key to making good profits here. You can’t sell many F&I products if you can’t convert them to dealership financing.

Service contract penetration is down a bit for them – TBOC is at 41 percent. This is an opportunity for improvement. Pre-paid maintenance is coming back up as dealers are over the shock of increased redemptions. Again, the idea is to use this product to get them back into your store so you can sell them more stuff, not to make money because they didn’t use the program. There are also opportunities for improvement in security systems sales and GAP penetration. TBOC is doing much better in these areas.

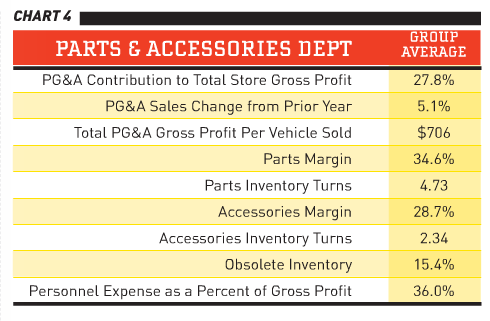

In the PG&A area (Chart 4), we are still seeing a slight increase in sales. Gross profit of $706 is nice, and this is a number you can compare with very easily. Do it. See where you stand in relation to this group. Parts turns are good. Generally, you want to be between four and five. The accessories margin is low. TBOC is holding 30.4 percent as compared with this group’s 28.7 percent. The number of turns is low as well. However, they have dropped their obsolete inventory to 15 percent from over 20 percent. It is extremely important to keep this number as low as possible. Turn these dollars around and purchase high-turn PG&A inventory. This will increase your gross profit substantially.

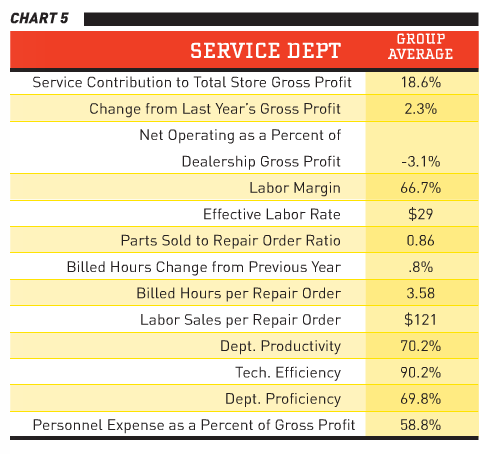

Chart 5 is showing that they have increased their service gross profit. They were at -3.2 percent in August. However, the net operating profit is still not a positive number. One reason is because they are not hitting the 70 percent minimum gross profit to pay the bills. This means their tech compensation is too high for the revenue. In comparison, TBOC is at 70.1 percent. Their effective labor rate is well below TBOC’s $40. On a good note, they have increased their billed hours per repair order from 1.62 to 3.58. Productivity and proficiency are both well below the 85 percent benchmark, and efficiency should be at least 100 percent. This is really hurting their profitability in this department.

Please use this information to compare your dealership’s performance. It is important to know what is going on in your business and to have reference points for comparison. If you have any questions, please feel free to contact me.

At GSA we track benchmarks through our involvement with dealer 20-groups. The TBOC data comes from the groups that are in the a real-time, web-based data reporting system. National Norms are compiled from the groups that report in the former-RPM data system.

Note: Our Voyager 4 data reporting and analysis system is available for any dealership to use for a very nominal fee. For more information on the data reporting system, dealer 20-groups, on-site consulting or training, drop me an email at [email protected] or visit www.gartsutton.com.