At GSA we track benchmarks through our involvement with dealer groups such as the Best Operators Club. Some of the members have kindly consented to let us share their numbers from our real-time, web-based data reporting system.

Magazines and magazine contributors are often criticized for focusing on larger dealers in their articles. However, it is possible for smaller dealers to really stand out in this business as well. This month we’re going to look at a smaller dealership that is not only surviving, but making a good profit despite the tough retail environment. The figures shown are for the month of August 2008.

Last year this dealer sold 450 motorcycles, ATVs, scooters and snowmobiles. Due to the slowdown, they expect to retail less than 400 this year. They are located in a town with a population of 5,000 on the northeast coast. They only have a market area of around 30,000 people, so they must work hard to get unit sales. These are augmented by seasonal tourist business in P&A and service. The dealership has an excellent reputation for providing exceptional customer service in all areas.

They employ one sales manager, twp salespeople, one F&I person, a parts manager with one sales agent and a service manager with two-and-a-half techs.

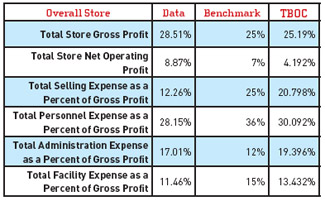

Chart 1 reveals that this dealer is maintaining an astounding 28.5% gross profit with a net of almost 9 %! This is well above both the benchmarks and the TBOC numbers. You can see that much of this profit comes from their control of expenses. Notice that the TBOC has also been working hard to get expenses in line. It’s time to really tighten up the income to expense ratios.

Chart 1

CY: current year

PVS: per vehicle sold

TBOC: average of the top five BOC members in this category

* Some rows and columns without data have been removed to reduce table sizes.

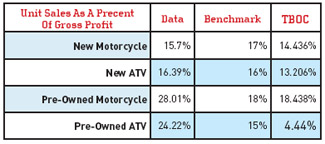

Chart 2 shows that they work hard to hold unit margins. This is critical in a down market. However, you must have your inventory under control.

Chart 2

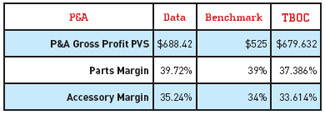

Chart 3 shows that they are making a real effort to sell parts clothing and accessories with every unit. They run a lot of special promotions and sales on P&A, but they hold their margins.

Chart 3

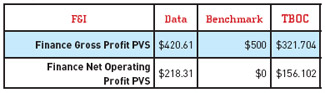

As you can see in chart 4, they are knocking it out of the park in F&I as well. Check out that net operating profit of $218 per vehicle sold!

Seriously, customers are happier when they go home with the right gear, maintenance products and accessories to do what they bought the unit to do: enjoy the ride.

Chart 4

So how do they do all this? Well, they do a lot of grassroots marketing. They work the events in their area, run coupon specials for P&A and service, and make use of email, direct mail, windshield flyers and ads in the area’s shopper magazine (this works well in some markets). They tie as much of this marketing as they can to the local events to maximize traffic. They also offer services like pick-up and delivery — free to purchasers of their platinum-level pre-paid maintenance (PPM) program. They work their PPM program hard and are very successful with it.

They control personnel expense by using qualified, part-time employees who have other jobs or are semi-retired. This reduces their outlay for benefits and insurance while ensuring proper staffing at peak times.

You can succeed during times like these. You have to make the effort to scrutinize every expense, utilize inexpensive, targeted advertising and hold your margins. Whatever you do, always remember that your customer service is what keeps them coming back.

Destination Dealership: Motorcycles of Dulles

Find out how this dealership maintains excellent ratings.

John Tisch, the owner of Motorcycles of Dulles, is a modest person. Despite the fact that he moves more motorcycles than most dealers on the Eastern Seaboard and his operation has a 4.9-star rating on Facebook and a 4.8-star rating on Google, he hastens to state that the success of the dealership is due to the vision of his now-retired partner, Ken Davis, and his great staff. “I can't take credit for this,” Tisch says. “We have a superb reputation in the industry and I am only one part of that. It's all the folks who work here who make this place.”

Destination Dealership: Northern Colorado (NOCO) Powersports

This dealership is riding the Rocky Mountain high.

Destination Dealership: Spyke’s KTM

Spyke’s KTM serves as racer headquarters for the Lafayette, Indiana, area and beyond. The dealer offer tons of vehicles, apparel and parts for on and off-road adventures.

Destination Dealership: iMotorsports

A lesson in constantly reevaluating your target markets.

Destination Dealership: Inside Moon Motorsports

Moon Motorsports in Minnesota is a family-owned dealership that has been in operation since 1955.

Other Posts

Establishing the Right Pay Plan for Your Dealership’s F&I Team

In an industry where skilled F&I professionals are in high demand, an attractive, fair and equitable pay plan becomes a key tool.

AJ Meisel Creates Community at Plano Kawasaki Suzuki

AJ has learned a thing or two over her 30-year powersports career.

How Mentoring Can Help Overcome the Technician Shortage

Is your service department suffering from being in the 80%?

Be a Leader, Not a Boss in Your Service Department

A real leader will exhibit strengths in three areas: transparency, trust and respect.