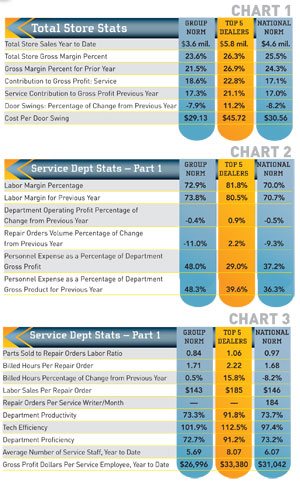

We’ll be comparing June data from a good-performing metric 20-group with the national norm (NN) numbers and the averages for the Top 5 dealers for this group in each category. We provide some of the key total store metrics as a point of reference for the service numbers.

We’ll be comparing June data from a good-performing metric 20-group with the national norm (NN) numbers and the averages for the Top 5 dealers for this group in each category. We provide some of the key total store metrics as a point of reference for the service numbers.

Total store gross margins have continued to improve but are still anemic overall for this particular group. The target is a minimum of 25 percent to ensure profitability. The service departments’ contribution to the total store gross profit has improved by more than 1 percent for both the group and the Top 5, but was flat for the national norm. We’d like to see this number above 18 percent.

Following a pattern for this year, door swings increased for the Top 5 and decreased for the rest. Notice that the Top 5 invested more in getting people in the door (cost per door swing), and it paid off.

Labor margins (labor sales less tech compensation) are all looking good — at or above the 70 percent benchmark. The Top 5 continue to outperform with margins above 80 percent. They are not underpaying their techs; they are helping them be more productive. They’re reducing tech downtime by pre-staging service jobs, providing special tools near their workstations, having service parts in stock and delivering them to their work area, and having multiple lifts available so techs can move from one job to another.

Note the drop in personnel expense for the Top 5. Personnel expense includes everyone who is not a

technician — service writers, lot porters, service managers, etc. A 10 percent drop is huge since personnel expense eats a bigger chunk of your profits than anything else. This is probably a big part of the reason their contribution to the overall store gross profit is high compared with the NN.

The parts to labor ratio should be close to 1:1 or better. Along with the hours sold per repair order, this is an indicator of the effectiveness of service writers.

Billed hours per repair order increased for the group and the Top 5, but decreased for the NN dealers. We really want to see these above two hours.

I included the average number of repair orders per service writer, per month in this chart. It is only available as a NN number, but provides a look at how well they are utilized.

We have found that above 180, it is difficult for the service writer to do his or her job properly. A good service writer needs sufficient time to build a relationship with the customer, do a proper walk-around, capture all of the services and repairs that should be done, and take advantage of up-sell opportunities. Of course, this assumes that you have the right person in this job, and that person has the proper sales and customer relations training.

Whenever your techs are not cranking a wrench, they are costing you. If you have a $60 per hour labor rate, every minute of their time is worth $1 to the store. At $90 per hour, this becomes $1.50. Open your wallet, take out $8, and light it on fire for every five minutes that one of your techs isn’t cranking labor.

As I pointed out earlier, the reason that the Top 5 dealers do so well in this department is because they maximize the time that techs are on the job. This is called productivity (available hours versus hours billed), and it shows in their numbers. In addition, their techs average much higher efficiency — billed hours versus the hours actually clocked in on service jobs. Help them be more productive, and they will be more efficient (if you have provided sufficient, quality training). In the end, it also shows in the gross profit dollars per service employee.

Where is your dealership performing in relation to these numbers?

Steve Jones, GSA senior projects manager, outlines dealerships’ best business practices to boost margins, increase profitability and retain employees. His monthly column recaps critical measurements used by the leading 20-group dealers. Access to the new Voyager 5 data reporting and analysis system is available to any dealership for nominal fee. For more information on GSA’s management workshops, data

reporting system, dealer 20-groups, on-site consulting or training, send Steve an email at [email protected] or visit www.gart-sutton.com.