We’ll be comparing August data from a good-performing metric 20-group with the National Norm (NN) numbers and the averages for the Top 5 dealers for this group in each category.

We’ll be comparing August data from a good-performing metric 20-group with the National Norm (NN) numbers and the averages for the Top 5 dealers for this group in each category.

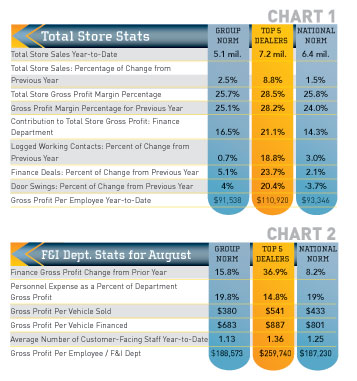

The members of this group are diverse in size. Their total revenue ranges from $3 million to just over $10 million year-to-date. The group average is $5 million, with the Top 5 averaging over $7 million. National Norm for all group members is nearly $6.5 million.

Sales are up more than the NN for both the group and the Top 5, and all three are above the target 25 percent gross margin. The Top 5 are closing in on the 30 percent mark. Given the struggle dealers have had just getting to 25 percent, this is quite impressive. The NN dealers have made a significant improvement over last year with almost a 2 percent jump in gross profit margin.

The emphasis that is being placed on the F&I department really shows up when you look at the contribution to gross profit. The Top 5 dealers are working hard to take advantage of the large margins that F&I products bring to the table, leading the group average by over four percent and the NN dealers by almost seven points! We’ll show how this pays off later in the article. Notice also the 23 percent increase they had in financed deals over 2012. They are making a strong effort to maintain multiple lending sources. This increases their ability to finance a higher percentage of their marginal buyers.

The emphasis that is being placed on the F&I department really shows up when you look at the contribution to gross profit. The Top 5 dealers are working hard to take advantage of the large margins that F&I products bring to the table, leading the group average by over four percent and the NN dealers by almost seven points! We’ll show how this pays off later in the article. Notice also the 23 percent increase they had in financed deals over 2012. They are making a strong effort to maintain multiple lending sources. This increases their ability to finance a higher percentage of their marginal buyers.

The percent of change for door swings is up over 20 percent for the Top 5, while the NN dealers have dropped almost four points. Top 5’s gross profit per employee year-to-date is almost $20,000 higher than the group or NN dealers.

How do you compare? It’s not hard to figure out: Take your total gross profit dollars and divide by the number of

employees (you’ll have to average them for year calculations).

OK, here’s where the extra effort really starts to show. Finance gross profit is up from last year for all numbers, but is way up for the Top 5. At the same time, they have kept personnel expense low as a percent of that gross profit.

Are you in that $500 per vehicle sold category? If not, imagine what that would add to your bottom line — remember; this is gross profit, not revenue. They are all doing OK in the per vehicle financed area, but remember the increase in percent of deals financed for the Top 5.

Relate that to the results in gross profit per employee. The Top 5 dealers’ F&I people are cranking over $70,000 more in gross profit year-to-date than the group or the NN. That’s almost $10,000 more a month!

Despite the difference in sizes for these dealers, they all have just more than one F&I person. The fractions come about because they have part-time or back-up staff that helps when they’re crankin’ sales. Quite often, the sales manager is a back-up F&I person. We strongly recommend that your sales manager go through a high-quality F&I training course. Not only does it help them take over when needed, they will have a better understanding of the need for F&I products and how they fit into the overall sales picture. We frequently have both sales managers and F&I producers in our F&I workshops.

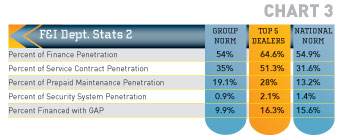

Here again you can see a reflection of the focus on F&I for the Top 5 dealers. They have over 10 percent more finance penetration than the group average and almost as much over the NN dealer average. As you saw in the previous graph, F&I gross profit per vehicle financed is significantly more than per vehicle sold. On top of that, they are rockin’ with service contracts as well. Good profits and happier customers result from selling this product.

Prepaid, or priority maintenance as we prefer to call it, is another strong product for these dealers. The goal here is to drive them back into your store for service. Maintaining a strong service customer relationship will result in more sales for all departments, including unit sales.

This particular group is not as strong in security products sales as some other groups. We are finding that these products have a good following if dealers will simply offer them to their customers. If you haven’t noticed, we sell some expensive toys, and we often have an emotional attachment to them. Having a theft-deterrent option is important to many customers.

GAP sales continue to grow for most dealers. Again, it is particularly valuable for purchasers of high-end or expensive units.

Steve Jones, GSA senior projects manager, outlines dealerships’ best business practices to boost margins, increase profitability and retain employees. His monthly column recaps critical measurements used by the leading 20-group dealers. Access to the new Voyager 5 data reporting and analysis system is available to any dealership for nominal fee. For more information on GSA’s management workshops, data reporting system, dealer 20-groups, on-site consulting or training, send Steve an email at [email protected] or visit www.gart-sutton.com.