In this article, we’ll be comparing February data from a good-performing metric 20-group, the National Norm (NN) numbers and the averages for the Top 5 dealers of the group in each category.

In this article, we’ll be comparing February data from a good-performing metric 20-group, the National Norm (NN) numbers and the averages for the Top 5 dealers of the group in each category.

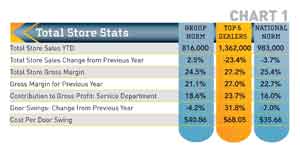

Total store sales were up slightly for the group, but dropped considerably for the Top 5 and almost 4 percent for the NN dealers. Many of these dealers are located in areas that were hit hard by bad weather, so that may have been a factor.

Despite the reduction in total store sales, the overall gross margins continued to improve. It is worth noting that these dealers held tighter to their

margins as sales tightened up. It seems logical, but many dealers go the other way and resort to heavy discounting to improve sales. You have to weigh the profitability against the volume because oftentimes, it is worthwhile to sell less and make better profits. Remember, gross profit pays the bills.

Door swings continued to improve for the Top 5, but they paid a premium for it. Last year, these dealers averaged $32, $53 and $30 per swing, respectively. In the case of the group and NN dealers, this could be a result of fewer swings for the money spent. In other words, they may not have spent more money than last year, but they got fewer swings for what they did spend.

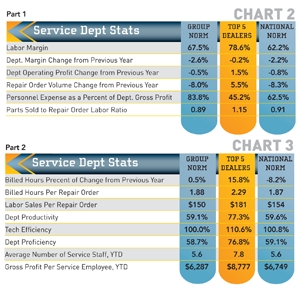

Labor margins were down slightly. This indicates that overall revenue was down relative to tech compensation. Most of these dealers are ramping up staff for the coming season, but the business has not started rockin’ yet — these numbers only reflect February business, after all. The target for labor margin remains 70 percent (labor revenue less tech compensation). Dealers need this much gross profit in order to cover the expenses and end with a profit. As you might expect, repair order volume was down around 8 percent for the group and NN dealers; however, it was up for the Top 5.

Labor margins were down slightly. This indicates that overall revenue was down relative to tech compensation. Most of these dealers are ramping up staff for the coming season, but the business has not started rockin’ yet — these numbers only reflect February business, after all. The target for labor margin remains 70 percent (labor revenue less tech compensation). Dealers need this much gross profit in order to cover the expenses and end with a profit. As you might expect, repair order volume was down around 8 percent for the group and NN dealers; however, it was up for the Top 5.

The increase in personnel expense as a percentage of department gross profit indicates staff increases prior to the season. This number represents the non-tech staff such as service managers, service writers, lot techs, etc. In general, we see successful dealers having about an equal ratio of techs to non-tech staff. In other words, if a dealership had four techs, you would expect to also see four people in support staff roles.

The target for the parts sold to repair order labor ratio is 1:1. The service department should represent 35 percent to 40 percent (or more) of your parts sales. This is your biggest parts customer, and they need to be treated as such. Service parts need to have priority for fill rate and order status. There should be a designated parts person (usually the shipping/receiving person) who is responsible to respond to service parts needs quickly. Tech time is the most expensive hourly time in your store.

Everything you can do to maximize the time techs are on jobs will return greater profits and higher customer satisfaction.

Billed hours are up nicely for the Top 5, but took a drop for the NN dealers. Hours per repair order are up across the board from last year. This indicates improvements in the service writer processes. If service writers have the time to properly greet your customers, establish rapport, thoroughly check over the unit and up-sell where possible, they will sell more service labor and parts. In addition, you’ll have happier customers. The goal is to uncover and satisfy all of the customer’s wants and needs without

follow-up calls asking for additional repairs. Surveys prove that each additional “We found additional repairs…” phone call reduces customer satisfaction with your service operation. That impacts your

ability to retain these customers and sell them their next motorcycle, ATV, UTV snowmobile or PWC.

Productivity and proficiency are way down from the target of 85 percent. This means that techs are doing a lot of things besides working on units. I suspect that most of these dealers are finding “projects” to keep them busy (and paid) while waiting for the season to break. This is backed up by the fact that they are billing around 100 percent for the hours that they are working on units (efficiency).

Gross profit money sold per employee is a very important measurement of the effectiveness and productivity of your staff. Monitor this closely throughout the year. One of the reasons it is so much higher for the Top 5 is that their average employee is above average in performance. In addition, their staffing ratios are proportionately correct — they have sufficient service writers. If your service writers are consistently doing 200 or more repair orders per month, they won’t have time to maximize parts and labor sales, let alone uncover all the needed repairs or services.

Steve Jones, GSA senior projects manager, outlines dealerships’ best business practices to boost margins, increase profitability and retain employees. His monthly column recaps critical measurements used by the leading 20-group dealers. Access to the new Voyager 5 data reporting and analysis system is available to any dealership for nominal fee. For more information on GSA’s management workshops, data reporting system, dealer 20-groups, on-site consulting or training, send Steve an email at [email protected] or visit www.gartsutton.com.