In this column, we will compare a selected metric dealer 20-group’s F&I department data with the metric National Norm numbers (overall averages for all our metric 20-groups) and the average of the Top 5 performing dealers per line item.

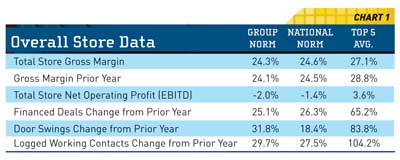

As in past articles, I am including some overall store data for February in Chart 1. This provides a bit more perspective when viewing the F&I department’s performance.

The total store gross profit is close to last year’s number, except for the Top 5. Although they are still higher than the group or national norm numbers, the Top 5 dealers have lost almost 2 percent when compared with February of 2011. At the other end of the scale, the Top 5 are showing weak but positive net, while the other dealers are averaging negative numbers. A really good sign is the increase in finance penetration across the board. The Top 5 numbers reveal increased focus in this area. The Top 5 are rockin’ when it comes to getting traffic through the door as well.

Despite the good increase, I suspect part of the huge increase in working contacts for the Top 5 reflects an improvement in enforcement of capturing customer information. Following up on customer information from the log or CRM is a major tool for increasing floor traffic (see the Top 5 door swings). Can you say prospecting?

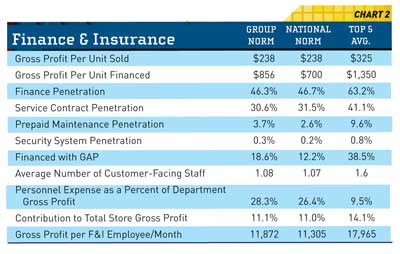

Chart 2 gets into some of the key performance indicators for the F&I department. The gross profit per unit sold for the group and the NN are the same, but the per unit financed indicates that the group is doing a better job of increasing sales on financed units. At almost $200 per copy, that is quite significant. The Top 5 are swinging for the fences with their numbers in both areas. Focusing on F&I is absolutely worth the effort. It starts with having a well-trained F&I producer with an aptitude for this position. Our F&I school is becoming more popular every year as dealers

recognize that the return is very high for this investment.

Look at the finance penetration from the Top 5. This is impressive, and obviously achievable. What it takes is primarily what I have harped on for years. You need to cultivate multiple finance sources so you can capture the financing for the majority of your customers. You also need to have a motivated F&I person who is skilled at making conversions of cash and outside financing customers to your dealership’s financing sources. If you let the financing go outside your store, you will lose F&I sales and maybe some add-on accessories to boot.

Service contract penetration is still rising and pre-paid maintenance (we prefer the term “Priority Maintenance”) is also coming up. GAP is finally starting to show the kind of penetration we had hoped to see years ago. This is a good product with strong benefits for most consumers.

The average number of customer-facing staff gives you an idea of the size of these dealers. When you look at the contribution to the total store gross, you can really see the value for this department. If you ever wondered if training pays off in this area, look at what the Top 5 dealers are doing per employee per month — remember this reflects the numbers from just January and February! It is also a good number to use to compare with any size of dealer.

The goal for these articles is to get you thinking about the performance you could be achieving.

I hope you will take this information and use it to compare and improve the performance of your F&I department. If you haven’t put a reasonable amount of focus in this area of your business, I urge you to reconsider. The potential is huge. May you rock ’n roll with F&I in the coming year! MPN

Steve Jones, GSA senior projects manager, outlines dealership best business practices to boost margins, increase profitability and retain employees. His monthly column recaps critical measurements used by the leading 20-group dealers. GSA is recognized as the industry’s #1 authority on dealer profitability.

Access to the new Voyager 5 data reporting and analysis system is available for any dealership for nominal fee.

For more information on GSA’s data reporting system, dealer 20-groups, on-site consulting or training, email [email protected] or visit www.gartsutton.com.