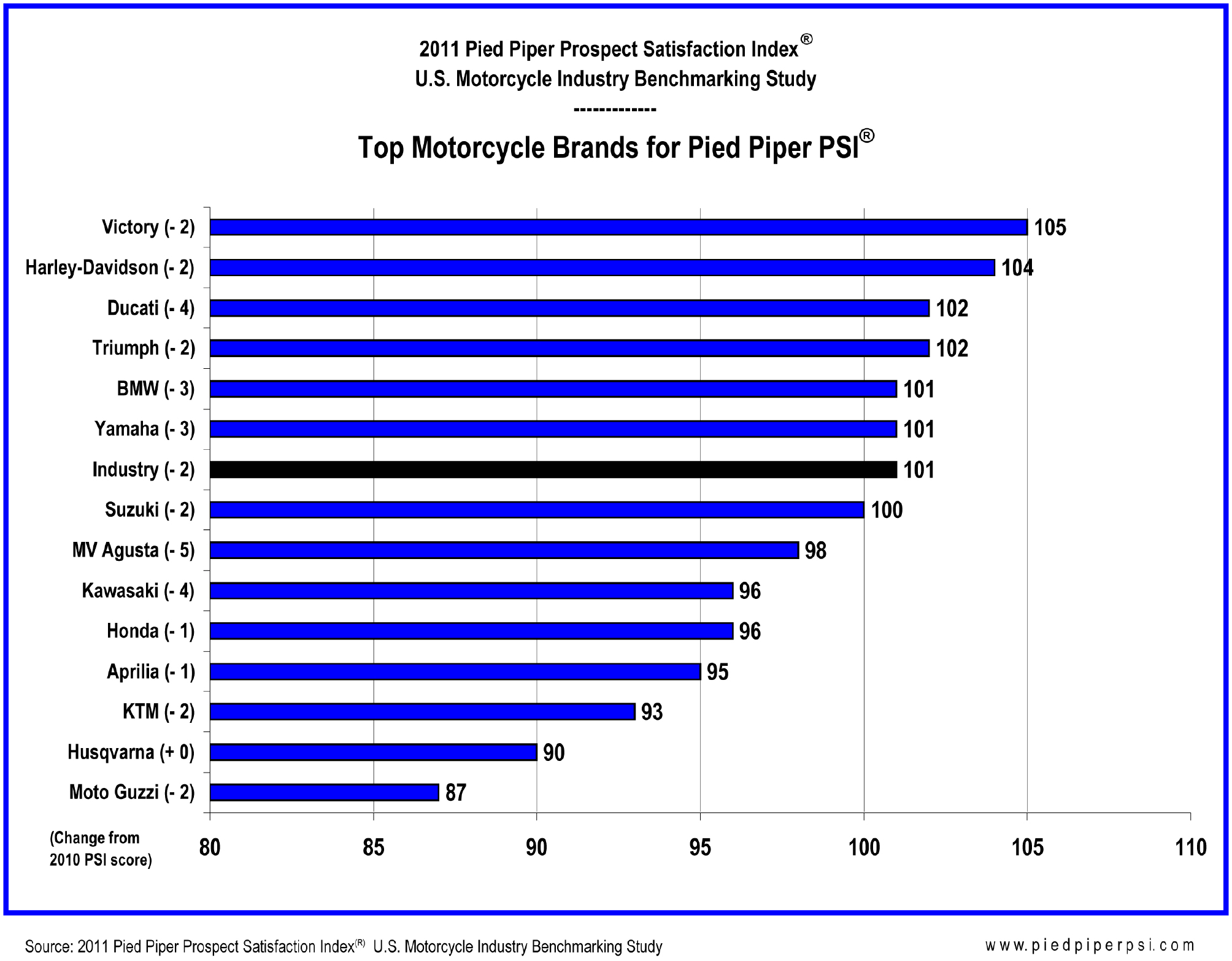

The Victory Motorcycle brand from Polaris Industries, Inc. maintained its top ranking in the newly released 2011 Pied Piper Prospect Satisfaction Index (PSI) U.S. Motorcycle Industry Benchmarking Study. Harley-Davidson finished second, while Ducati and Triumph tied for third, followed by BMW and Yamaha, all of which scored above the industry average.

2011 marked the fifth year for the independent Pied Piper PSI benchmarking study, which sent 1,967 hired anonymous “mystery shoppers” into motorcycle dealerships nationwide. The study measured how effectively each brand’s dealerships helped motorcycle shoppers become motorcycle buyers.

Victory defended its top ranking despite a lower PSI score compared to the previous year. Overall motorcycle industry performance also declined across a majority of the sales process activities tracked by the study, which led to lower PSI scores for thirteen of the fourteen major motorcycle brands.

Victory dealerships led the industry overall in multiple sales activities such as providing a product walk-around demonstration, mentioning the availability of financing options, mentioning the availability of accessories, and pointing out features unique from the competition. Eleven different brands led at least one sales process category. For example, Harley-Davidson salespeople were most likely to mention specific features and benefits tied to the shopper’s wants and needs. Ducati salespeople were most likely to offer a test ride. Triumph salespeople were most likely to ask for the sale. BMW and Yamaha salespeople were most likely to make an effort to write-up a transaction.

The past two years have been challenging for the U.S. motorcycle industry, with retail sales stuck at roughly one-half of the pre-recession level. The effectiveness of dealership selling actually increased from 2009 to 2010 despite the challenging sales environment, but from 2010 to 2011 the industry gave back most of the sales process improvements as dealership profitability and employment dropped. Notable sales process areas declining over the past year include the salesperson asking for the sale, providing compelling reasons to buy now, and offering a test ride. Sales process areas bucking the trend and improving over the past year include encouraging shoppers to sit on a motorcycle, salespeople introducing themselves to shoppers, and explaining service and maintenance programs.

“A strong dealership sales process is needed today more than ever,” said Fran O’Hagan, president and CEO of Pied Piper Management Co., LLC. “The days of ‘order-taking’ are over, and a helpful and effective salesperson can make the difference by turning a shopper into a buyer.”

The PSI study results also show that top-ranked brands are less likely to suffer from salespeople taking a prospect interested in one brand, and encouraging them to consider another brand instead. Less than one in ten Harley-Davidson, Victory and BMW shoppers encountered salespeople trying to promote another brand instead. In contrast, more than one in four Aprilia, Husqvarna, Kawasaki and Moto Guzzi shoppers experienced salespeople encouraging the shopper to consider another brand instead.

The 2011 Pied Piper Prospect Satisfaction Index U.S. Motorcycle Industry Study was conducted between July 2010 and April 2011 using 1,967 hired anonymous “mystery shoppers” at dealerships located throughout the U.S. For more information about the Pied Piper Prospect Satisfaction Index, visit www.piedpiperpsi.com.