At GSA we track benchmarks through our involvement with dealer groups, such as the Best Operators Club. Some of the members have kindly consented to let us share their numbers from our real-time, web-based data reporting system.

In this column we’re going to discuss a key indicator of survival in any dealership: total store gross profit margins (TSGP). This is derived from taking the total store revenue minus the cost of sales. Remember this: Gross profit pays the bills; TSGP pays your selling expenses, personnel expenses, admin expenses and facility expenses. In today’s world, you need to gross 23 to 25 percent profit in order to pay your bills. If you control your expenses properly, this means you have a shot at actually making a profit!

Today, we find average profitable dealerships netting around 2 to 5 percent overall. The target benchmark is 7 percent. If you are attaining a net profit of 7 percent or more in today’s economy, bless your heart! You really have your act together — pat yourself on the back.

Today, we find average profitable dealerships netting around 2 to 5 percent overall. The target benchmark is 7 percent. If you are attaining a net profit of 7 percent or more in today’s economy, bless your heart! You really have your act together — pat yourself on the back.

This dealer example is a 1,600-unit dealer located in a city of 100,000 that is very close to a major metro area. Some nearby dealers are heavy discounters. This dealer is trying hard to achieve adequate profitability while maintaining a reasonable volume.

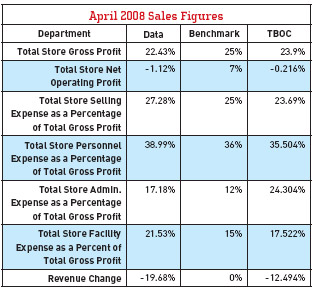

This chart is a snapshot of April’s overall store numbers for one of our groups. In general, April was not kind to many dealers, as you can see. This particular dealer had an overall GP of 22.43 percent, which resulted in his net loss of 1.12 percent. At 23.55 percent, he would have broken even. At 25 percent TSGP, his net would have been 1.45 percent. The TBOC was doing a bit better at almost 24 percent, but they were still short of breaking even at -0.2 percent.

If you look closely, you can see what is depressing the numbers. Revenue is down and his expenses are high when compared with the benchmarks and the TBOC (with the exception of admin expenses).

A deeper dive showed that this dealer’s new and pre-owned unit margins were down while flooring expenses were high. Does this sound familiar? This was not unusual for many dealers in April. His marketing expenses were also high compared to the TBOC. In other words, he promoted more to drive traffic and discounted slow-moving units in order to reduce flooring expenses.

So what might be some solutions? We would encourage him to:

- Continue to do what is necessary to get the new unit flooring costs under control. Once this is accomplished, grow your used sales to reduce exposure to new unit discounters.

- Improve used margins by ensuring your buyer has a grip on true market values. Subtract your desired margin and reconditioning from this to maintain profit. Seek additional acquisition sources.

- Increase the focus on high-margin P & A and F & I sales.

- Hold managers accountable for maintaining profitability or replace them.

As you can see, monitoring your overall store gross profit is essential to your survival.

Many dealers are reporting floor traffic and sales as having picked up dramatically over the last few weeks. Along with this should come increased profitability. Strive to work every sale for maximum profitability. Every deal stands on its own.