Black Book reported that prices this month reflect both normal seasonal trends as well as the fact that new model sales have been somewhat sluggish this year, with many dealers awaiting incentives from the manufacturers to help move inventory. This has naturally led to diminished demand on the used side as well, and prices this month are reflecting that.

The economy is also acting as a drag on pricing. A recent survey in the news found that for the first time in quite a while, a majority of respondents felt that a recession is likely in the next 12 to 18 months. Sentiments like this are surely putting a crimp in discretionary spending for many people, slowing large purchases like powersports vehicles.

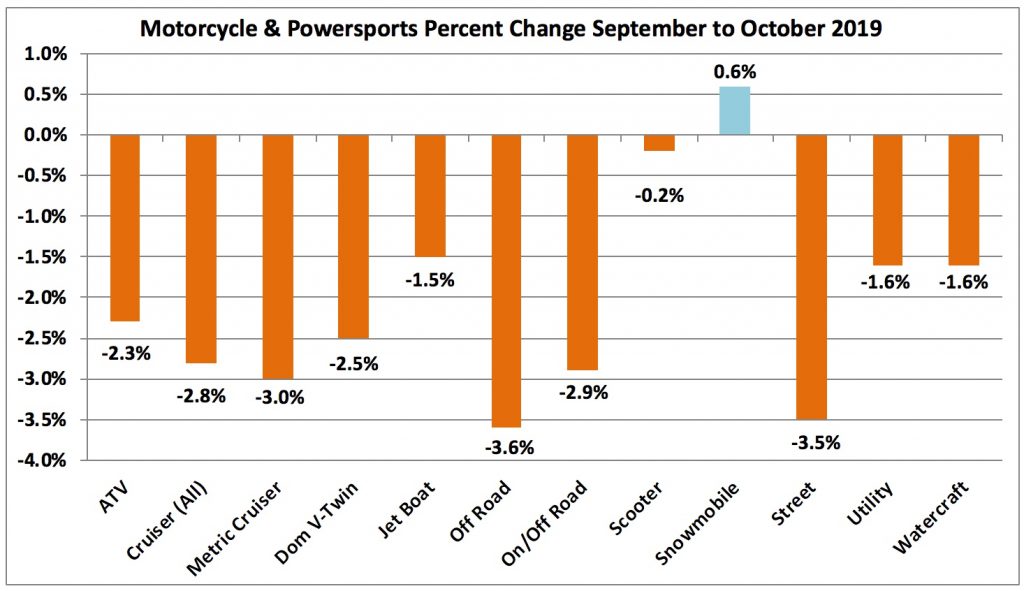

Among our biggest movers this month are the street bikes, down 3.5%, a large but not entirely unexpected drop considering the time of year. Rather surprisingly, the off-road bikes are down a touch more with a decline of 3.6%. The off-road vehicles as a group usually increase in value during the fall, but they, along with the utility vehicles and ATVs, are all down right now. The cruisers are expectedly down as well, with the domestic V-Twin models fairing slightly better than their metric counterparts. Snowmobiles are the only segment to see gains, a fairly modest bump of 0.6%, although auction volume remains low on these units.

“Very much like last month, prices are down across the board again as fall officially arrives. Not only are all of the on-road segments down significantly, which is fairly typical for the time of year, but the off-road segments are also down by unusually large amounts as well,” said Scott Yarbrough, senior analyst of motorcycle and powersports.

Link: Black Book