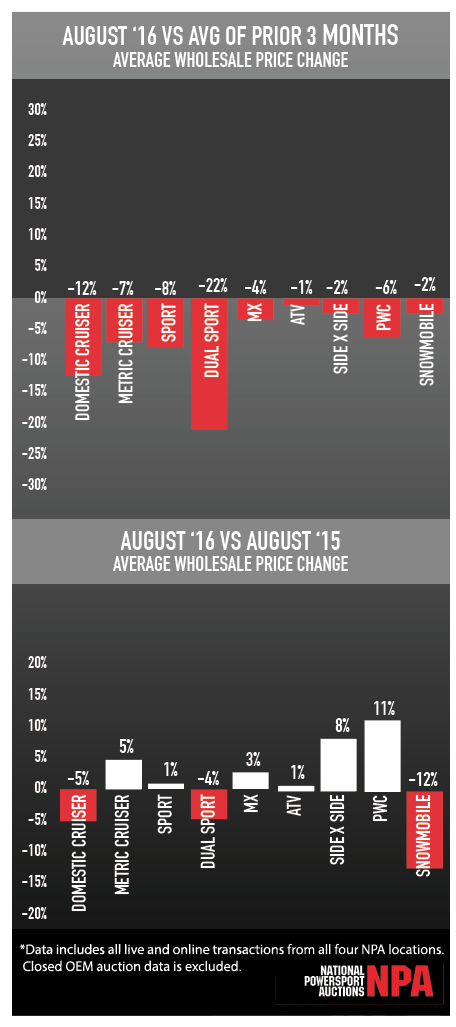

Temperatures during the “Dog Days of Summer” tend to be the hottest in August, and the opposite can be said for the “Dog Days of Powersports” when it comes to wholesale pricing. As 2016 continued its normal march, Average Wholesale Prices (AWP) declined further in August compared to the prior three months as the wholesale season reaches its annual bottom. AWP for all major categories declined 2-10% from the prior three months, with street motorcycles down 7-11% and off-road down 1-4%. Interestingly, when comparing AWP to last August, metric cruiser AWP actually rose 5% and other categories were mixed. This suggests that this year’s bottom is not as severe as 2015, all else being equal.

Temperatures during the “Dog Days of Summer” tend to be the hottest in August, and the opposite can be said for the “Dog Days of Powersports” when it comes to wholesale pricing. As 2016 continued its normal march, Average Wholesale Prices (AWP) declined further in August compared to the prior three months as the wholesale season reaches its annual bottom. AWP for all major categories declined 2-10% from the prior three months, with street motorcycles down 7-11% and off-road down 1-4%. Interestingly, when comparing AWP to last August, metric cruiser AWP actually rose 5% and other categories were mixed. This suggests that this year’s bottom is not as severe as 2015, all else being equal.

One change occurring this year is that the average model age for domestic cruisers has been relatively stable. Average model age at time of sale has been steadily growing each year as the repo pool ages, but this year domestic cruisers have been relatively flat and the aging of metric cruisers has slowed. In addition, the overall mix of product by type has remained stable, slightly reversing the trend towards a higher ratio of domestic cruisers and reflecting some growth in the ratio of metric cruisers and sport bikes.

As expected, wholesale pricing dropped a few more points in August. From this point forward, prices should remain relatively flat and start their upward trend later in the year. Pre-owned powersports remain a popular option for consumers, but retail sales for new powersports units were soft in Q2 and mixed so far in Q3. As a result, OEM incentives have been aggressive this summer and new product announcements and rumors surrounding the summer dealer shows have dampened wholesale prices on prior-year models. However, we believe that most of the resulting pressure on vehicle pricing has already been priced in, and that savvy dealers will see the next few months as terrific buying opportunities. With both floor plan and retail consumer financing readily available, 2016 should continue its normal trend as the powersports market finishes out the year.

All data provided by National Powersport Auctions. For more information, please visit www.npauctions.com or call (888) 292-5339