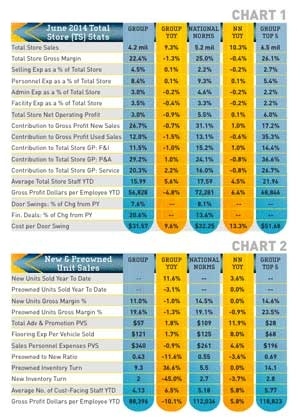

In our June year-over-year (YOY) comparison total store sales (Chart 1) were up around 10 percent for both the group and National Norm (NN) dealers. This is a very good sign. Total store gross margins declined slightly, indicating dealers were probably discounting product since expenses were not showing significant increases. Net Operating Profit was fairly flat compared to last year.

While there were not a lot of changes in the contribution to gross profit from various departments, it is interesting to note the differences in how the Top 5 split gross profit contribution in unit sales compared to the NN and Group dealers. They continue to get a much higher contribution from their preowned units than new.

Average total store staff levels are up over last year. Interestingly, personnel expense only changed significantly for the NN dealers’ sales department and for the Group’s service department.

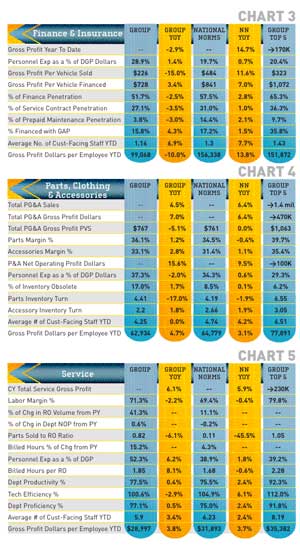

New unit sales (Chart 2) have increased by more than 10 percent for the Group dealers, but preowned dropped by 3 percent. This could indicate that they had to move out some excess new unit inventory. Margins remained pretty flat, but the Top 5 are getting 4 percent more margin on preowned than the other dealers.

Advertising and flooring expenses per vehicle sold (PVS) jumped dramatically for the NN dealers. They are very high, particularly when compared to the Top 5. Advertising expense PVS is diluted some by the higher volume of the Top 5.

The preowned-to-new ratio dropped for both the Group and NN dealers. Although they are selling roughly one preowned to every new (which is fairly good). They could be more profitable if they were more aggressive in this area. There is more margin in preowned. The Top 5 in the group are getting close to 1:1, which is the target for most highly-profitable dealers. Preowned inventory turns went way up for the Group dealers, but dropped a bunch for new sales. The Top 5 dealers had 14 turns in preowned.

This Group is suffering in the F&I department (Chart 3), which might indicate a need for training or possible staffing issues. Their gross profit is down, as are their penetration numbers. They are way off on gross profit per employee as well. It could even indicate a lack of focus on this department by a number of the dealers in this group.

The NN dealers on the other hand are showing much better numbers: up 15 percent in gross profit, up 12 percent in gross profit PVS and up 7 percent in gross profit per vehicle financed (PVF). In addition their penetration has improved in the categories shown. The Top 5 from this Group are rockin’ it with a PVF at $1,072 per copy, but behind the nation in PVS – this is partly due to the fact that they finance a larger percentage of their sales.

Parts, Clothing & Accessories (PC&A) is up in sales, gross profit and net over last year (Chart 4). The Top 5 dealers are doing a much better job of selling PC&A at $1,063 PVS. This indicates a well-trained staff with sales and merchandising skills. They lead the pack in margins as well. This department should generate 30-40 percent or more of total store gross profit. Parts turns have dropped for the Group. Four is the typical target, but six is not unusual if you are using an open-to-buy system and stocking the right stuff at the right time. Turns generate income, however, much more than six can indicate inadequate inventory.

Service gross profit is up, but margins slipped some for the Group and NN dealers (Chart 5). You want to see labor minus tech compensation equal a gross profit around 70 percent. Less usually means you will struggle to pay the bills for that department. Repair order (RO) volumes and billed hours are up as well showing an increase in sales. The parts sold to RO ratio is not good for the group or the NN dealers. This generally indicates issues with the service advisors – the wrong people in this slot, not enough advisors for the volume or a lack of proper training are all possibilities.

Shop performance numbers are decent for NN and the Group, but the Top 5 are really doing well due to having well-trained staff and good managers.

As always, the goal here is not merely to inform you of the health of these dealers, but to track your own numbers and compare them with these.

Steve Jones, GSA senior projects manager, recaps critical measurements used by the leading 20-group dealers. Access to GSA’s Voyager 5 data analysis & comparison system is available for any dealership for a nominal fee. For more information on Voyager, management workshops, dealer 20-groups, on-site consulting or training, send an email to [email protected] or visit www.gartsutton.com.