"/wp-content/uploads/Articles/06_01_2014/128171BOCjpg_00000076973.jpg">

In this month’s Best Operators Club, the article contains actual numbers obtained from our 20-group data reporting and analysis system. 20-groups consist of dealers from non-competing markets who meet three times a year to share financial and best practice information. The goal is to grow and improve their businesses profitably. GSA provides support, data reporting tools, guidelines, and moderates their meetings.

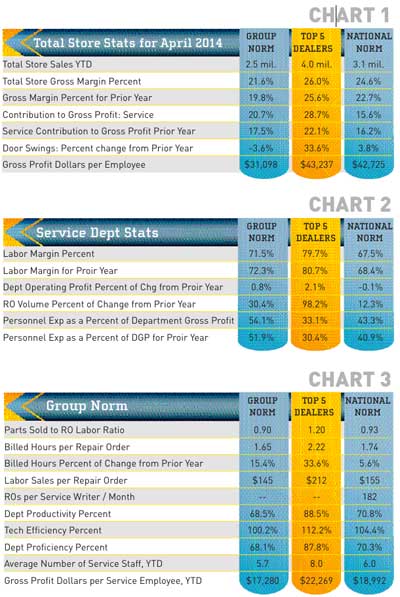

Key performance indicators for the overall store in Apirl are shown in Chart 1. These are provided as a point-of-reference for the department numbers.

Total store gross margin is anemic for the Group Norm as the target is 25 percent. The Top 5 and National Norm dealers are right on the mark. However, all three groups are up when compared with last year – this is a good thing. Service contribution to overall store gross profit has increased notably for the Group Norm as well as the Top 5, but dropped off slightly for the National Norm dealers.

Door swings are down a bit for the Group Norm, but up considerably for the Top 5 dealers. I noticed in the reporting data that the Top 5 dealers were paying considerably more per door swing, but it paid off. Once they got them in the door, the Top 5 and National Norm dealer staff did a better job of selling them something as indicated by the gross profit dollars per employee.

Labor margins are good for both the Group Norm and Top 5 (total labor less tech compensation). National Norm dealers are a bit short of the 70 percent goal. Margins slipped since last year, but not significantly. Operating profit is pretty flat across the board.

Repair Order (RO) volume went up considerably for most. This is in line

with the increase we saw in parts and accessories sales compared to last year – they do walk hand-in-hand. Personnel expenses (non-tech service employees) have risen across the board. I suspect this is due to changes in service advisor compensation. This position has been a focal point for many of the groups. They are aware of the value and potential ROI for having the right number of high-quality service advisors for the service volume.

The goal for parts to labor ratio is 1:1. The service advisor plays a key role in this. When dealers have sufficient well-trained service advisors for the service volume, this number increases. Overloaded service advisors don’t have the time needed to do the up-sells.

The goal for hours per repair order is two. Only the Top 5 are hitting it. Again, the service advisor is the key person in all of this. Repair orders per writer, per month is often an indicator. We like to see this number in the 160-170 range. It does tend to spike at certain periods of the year.

All are showing decent efficiency. However, productivity and proficiency should be at least 75 percent. Only the Top 5 are hitting it. This is an indication that they excel at keeping their techs turning wrenches. In particular, productivity (actual hours worked on repair orders divided by hours they were there to work) is the number to look at.

You really need a time clock to track this. Productivity goes up when techs don’t spend their time pushing bikes, chasing down special tools, pulling parts, etc. This is the most expensive hourly time in your dealership, and it is the department with the tightest profit margin. Pay attention to what goes on back there.

Compare your gross profit dollars per service employee. Where do you stack up? How is your productivity? If you want to become more profitable and have happier customers, you must first find the holes and then implement processes to fix them.

Steve Jones, GSA senior projects manager, recaps critical measurements used by the leading 20-group dealers. Access to GSA’s Voyager 5 data analysis & comparison system is available for any dealership for a nominal fee. For more information on Voyager, management workshops, dealer 20-groups, on-site consulting or training, send an email to [email protected] or visit www.gartsutton.com.