For September, prices in most segments we cover in the motorcycle and powersports market are down in rather dramatic fashion.

Activity at the auctions has slowed considerably, with significant numbers of “no-sales” at many locations. Dealer consigned units are selling at only about a 30 percent success rate at many venues and overall volumes are down across the board.

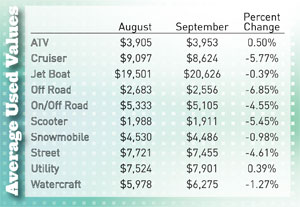

Off-road bikes lead the declines with a drop of -6.9 percent this month, with cruisers and scooters not far behind with drops of -5.8 percent and -5.5 percent respectively. Dual sports and regular street bikes are down slightly less, dropping by -4.6 percent each.

September typically sees reductions in auction activity, prices, and volume, but nowhere near these levels. These drop-offs continue a trend that has been going on for the past several months, where auction volume has been lower than normal and, somewhat surprisingly, prices have been as well. The only segments bucking these trends are the ATVs and utility vehicles. They are each up slightly from last month. The increases are only a few dollars in many cases, with the average rise in value versus last month being .5 percent for the ATVs and .4 percent for the utility vehicles.

Normally we would see these units commanding quite a premium this time of year as dealers stock up for the farmers, hunters, and outdoorsmen, who put these units to heavy use over the next few months, but that has not occurred yet.

In a similar seasonal situation to the ATVs and utility vehicles, snowmobiles, which should be picking up in value, are once again down by 1 percent. The arrival of cooler weather should help these units, but in the current market conditions, who knows by how much?

To finish up, the personal watercraft segment is down by -1.4 percent, while jet boats are down -.4 percent.