Prices in the powersports market have peaked for the year. The normal high point for motorcycle and powersports pricing usually occurs around July 4 — before that prices generally rise and after that, they begin to decline as dealers sell off their bike inventory before the end of riding season in some parts of the country and begin to stock up on ATVs for the fall season.

Let’s first look at a couple of bright spots. The domestic V-Twin segment, though not broken out individually from the cruisers, has managed to buck the overall negative price changes this month, seeing increases in the 1 percent range. Additionally, sport bikes, which are included in the street bike segment, have also generally increased in value by a small amount, though the overall segment is down by .6 percent.

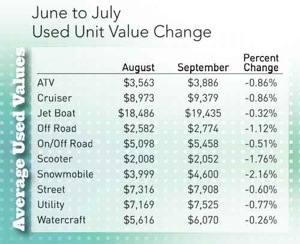

The only other relatively positive news comes from the personal watercraft and jet boat segments, which have seen only tiny declines of .3 percent in value.

Off-road bikes are down by 1.1 percent, while dual sports are down by half a percent. Scooters have dropped by 1.8 percent.

Snowmobiles continue to languish in values and auction activity again this month and see prices drop by 2.2 percent.

The ATVs and utility vehicles have not started their seasonal appreciation yet, dropping by .9 and .8 percent respectively.

Overall, it has been a year of weak price appreciation, and it will be interesting to see if the fall price drops are as moderate as the increases have been or if the soft market will see larger declines than normal in the coming months. Keep checking with us each month to stay on top of the latest trends, no matter which way the market goes.