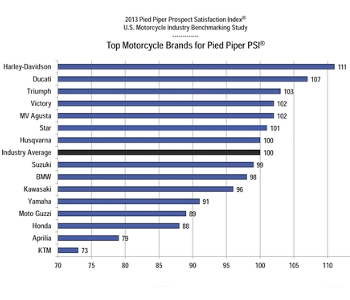

Harley-Davidson dealerships were top-ranked in the newly released 2013 Pied Piper Prospect Satisfaction Index (PSI) U.S. Motorcycle Industry Benchmarking Study, which measured dealership treatment of motorcycle shoppers. Study rankings by brand were determined by the patent-pending Pied Piper PSI process, which ties “mystery shopping” measurement and scoring to industry sales success.

Harley-Davidson dealerships were top-ranked in the newly released 2013 Pied Piper Prospect Satisfaction Index (PSI) U.S. Motorcycle Industry Benchmarking Study, which measured dealership treatment of motorcycle shoppers. Study rankings by brand were determined by the patent-pending Pied Piper PSI process, which ties “mystery shopping” measurement and scoring to industry sales success.

For the first time since 2008, Pied Piper also separately measured how effectively motorcycle dealerships responded to customer inquiries received online through dealership websites.

Harley-Davidson dealerships led all brands in 18 different sales activities, such as encouraging shoppers to sit on a motorcycle, asking for contact information and helping the shopper overcome obstacles to the purchase. 11 different brands led at least one sales process category, and brand performance varied considerably from brand to brand. For example, Ducati salespeople offered a brochure to approximately nine shoppers out of 10, while less than half of Suzuki, Honda or Kawasaki salespeople offered a brochure. BMW, Triumph and Harley-Davidson salespeople were more than twice as likely to offer a demo ride as the salespeople at Ducati, Suzuki, Honda and Yamaha dealerships. Victory salespeople were most likely to suggest arranging a demo ride in the future.

Industry average dealership performance was mixed when comparing 2013 with the previous year.

Salesperson behaviors more likely in 2013 than 2012 include the following:

- Offering demo rides (now 19 percent of the time)

- Discussing features unique from competitors (now 49 percent of the time)

- Encouraging going through the numbers or writing up a deal (now 33 percent of the time)

Salesperson behaviors less likely in 2013 than 2012 include the following:

- Conducting a walk-around demonstration (now 70 percent of the time)

- Overcoming shopper objections (now 74 percent of the time)

- Giving compelling reasons to buy now (now 39 percent of the time)

2013 marks the seventh consecutive year of Pied Piper PSI motorcycle industry benchmarking studies. With seven years of data gathered from tens of thousands of motorcycle PSI evaluations nationwide, Pied Piper was able to fine tune the study questions, weightings and scoring for 2013. As a result, Pied Piper reset the 2013 motorcycle industry average PSI score to “100.”

The resulting “second generation” PSI scoring is now even more closely correlated to motorcycle dealership sales success, according to the company. Pied Piper has found that on average, when motorcycle dealerships are ranked by their PSI score, dealerships in the top quarter sell 22 percent more motorcycles than dealerships in the bottom quarter. “Any motorcycle dealership faces plenty of challenges that are difficult, if not impossible, to change,” said Fran O’Hagan, president and CEO of Pied Piper Management Co. LLC. “In contrast, how a sales team sells is something a dealership can improve immediately.”

The 2013 Pied Piper PSI U.S. Motorcycle Industry Study was conducted between July 2012 and April 2013 using 2,503 hired anonymous “mystery shoppers” at dealerships representing all major brands, located throughout the U.S.

2013 Pied Piper PSI Internet Lead Effectiveness (ILE) U.S. Motorcycle Study

Much has changed over the five years since 2008, when Pied Piper last measured how effectively U.S. motorcycle dealerships handled customer inquiries received over the Internet. Back then, Pied Piper found that motorcycle dealerships responded within 24 hours – in any way – only 30 percent of the time. The comparable number in 2008 for the auto industry was 64 percent of the time, and auto-response CRM software in 2008 was uncommon.

Fast-forward to 2013, and Pied Piper found that motorcycle dealerships respond within 24 hours 72 percent of the time, while the same 2013 figure for the auto industry is 93 percent of the time. Unlike in 2008, auto-response CRM systems are now common. Today, the first response to a motorcycle customer Internet inquiry is an auto response 56 percent of the time, a personal response 16 percent of the time, and no response of any type 28 percent of the time.

When ranked by PSI-ILE, Suzuki dealerships finished first, followed by Triumph, Star, Ducati, BMW and Husqvarna. PSI-ILE measures 19 different criteria, and two criteria of particular interest are whether the dealership answered a specific question posed by the customer, and whether the dealership attempted to follow up by telephone. The brands whose dealerships were most likely to answer the customer’s specific question were BMW, Star, Husqvarna, Suzuki and Ducati. The brands whose dealerships were most likely to attempt to contact the customer by telephone were Harley-Davidson, Suzuki, Triumph, BMW and Victory.

The 2013 Pied Piper PSI-ILE U.S. Motorcycle Study was conducted between September 2012 and April 2013 by submitting internet inquiries to a sample of 1,117 dealerships nationwide representing all major brands.