While 2011 was still filled with ups and downs and economic uncertainty, most of our dealers saw a pattern of increased profitability and slow growth. Part of this was certainly due to the efforts these dealers made to control expenses and implement or reinstate essential best business processes. Many of these dealers increased their training budgets, particularly for their managers. We had a full house for each of our management training classes this fall.

Develop Goals

As you digest your dealership’s year-end results, you should be developing your goal plans for the coming year. Following these proven SMART goal-setting guidelines will help:

• Specific: develop well-defined goals

• Measureable: you must be able to track the numbers

• Action-driven: do something to drive results

• Realistic: hit this goal, then set the next one

• Time-bound: set target dates

Here is an example: “We’re going to increase first-half new motorcycle sales compared with last year by 15 percent by June 30. We’ll accomplish this by providing our salespeople with individual sales goals, additional sales training, daily coaching and monthly performance incentives.”

Benchmarks and Targets

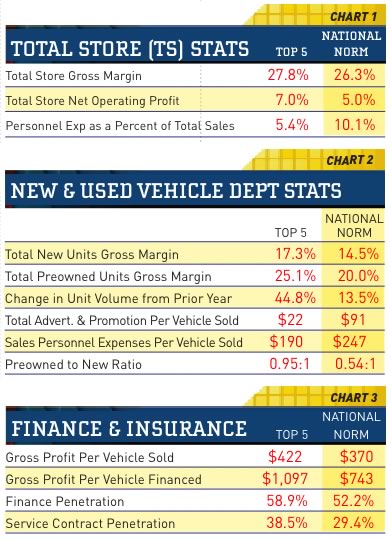

Here are some metric dealer numbers from late 2011 you can use to help you develop attainable goals for your dealership for 2012. The top 5 numbers represent the average of the top 5 dealers for any line item. The national norms are the averages for all of the metric dealers in our database.

Chart 1. The major goal when looking at total store stats is to achieve at least a 25 percent gross margin. That is what it will take for most dealers to achieve any net profit at all. Note the differences between the top 5 and the national norms. Top 5 dealers show 2 percent more net operating profit — much of that came from controlling their personnel expenses.

Chart 1. The major goal when looking at total store stats is to achieve at least a 25 percent gross margin. That is what it will take for most dealers to achieve any net profit at all. Note the differences between the top 5 and the national norms. Top 5 dealers show 2 percent more net operating profit — much of that came from controlling their personnel expenses.

Chart 2. Margins for new and pre-owned units are key numbers for the sales department. Top 5 dealers not only got high margins, they increased their volume over 40 percent compared with last year. At the same time, they spent less on advertising and personnel expenses. They also sold almost twice as many pre-owned versus new as compared to the national norm dealers.

Chart 3. In F&I, the goal should be at least $400 gross profit per vehicle sold and around $900 per vehicle financed. National norm finance penetration rose above 52 percent, and the top 5 got close to 60 percent.

This is really good news. The name of the game is to find lots of finance sources and form solid relationships with the ones that work for you.

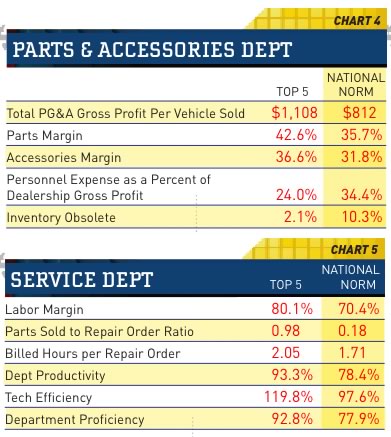

Chart 4. In PG&A the gross profit per vehicle is a good place to look for goal numbers. The differences between the top performers and the average dealers are huge in this department. This chart is a classic example of controlling overhead while striving for higher profits. This department represents high profit margins and the most potential contribution to paying dealership overhead. You should put a lot of effort into maximizing the returns here.

Chart 4. In PG&A the gross profit per vehicle is a good place to look for goal numbers. The differences between the top performers and the average dealers are huge in this department. This chart is a classic example of controlling overhead while striving for higher profits. This department represents high profit margins and the most potential contribution to paying dealership overhead. You should put a lot of effort into maximizing the returns here.

Chart 5. The service department has to hit close to a 70 percent margin, or it will not be able to cover its bills. That means tech compensation can’t exceed 30 percent of revenue. Do the math for your department. Since it’s all about time in this department, productivity, efficiency and proficiency track your service department’s performance.

Efficiency measures a technician’s effectiveness in completing assigned jobs.

Formula: Billed labor hours divided by actual hours worked on jobs

Productivity measures the Service manager’s ability to keep a steady flow of business going through the shop.

Formula: Actual hours worked on jobs divided by the hours available

Proficiency measures how much revenue is being generated from hours available in the Service Department.

Formula: Billed labor hours divided by the hours available

I have shown you what is possible. You must decide what is attainable and realistic for your store in order to establish your goals for 2012. The main point is that you need to do it! You should constantly be striving to reach goals for your business. There is simply no direction, no urgency to grow or improve unless you do this.

Steve Jones, GSA senior projects manager, outlines dealership best business practices to boost margins, increase profitability and retain employees. His monthly column recaps critical measurements used by the leading 20-group dealers. GSA is recognized as the industry’s #1 authority on dealer profitability.

Access to the new Voyager 5 data reporting and analysis system is available for any dealership for nominal fee.

For more information on GSA’s data reporting system, dealer 20-groups, on-site consulting or training, email [email protected] or visit www.gartsutton.com.