Optimism for the months ahead

Optimism for the months ahead

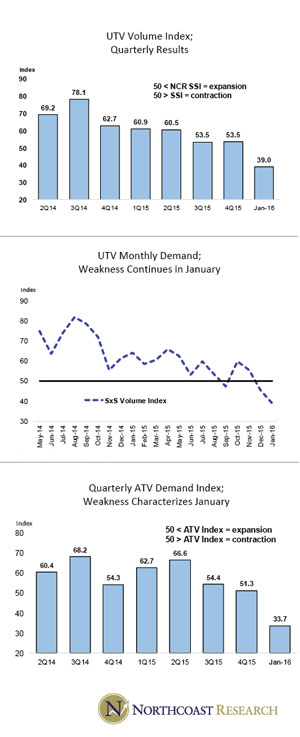

[dropcap]O[/dropcap]ur latest survey of powersports dealers indicates that January was slow for dealers across North America. It appears sales trends continued to be weak. Some key reasons cited for the decline include ongoing economic weakness throughout the oil patch; concerns with stock market volatility; and top-line pressures related to customers trading down to lower-priced units.

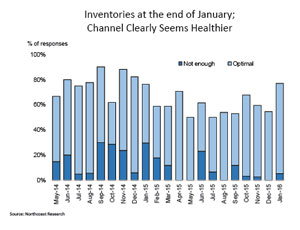

While still lackluster, it sounds as if sales benefited in the ROV and snowmobile categories from increased snowfall to end the year. The takeaways were not all negative, though, as dealers seemed to be more optimistic about the next few months. Indeed, it appears that inventory levels improved during the month, and many dealers noticed an increase – albeit modest – in traffic at the end of January and the early part of February.

While there are still a lot of mixed signals in the market place, most signs point to a relatively healthy U.S. consumer, and we feel incrementally more positive about the health of the industry.

Seth Woolf, a research analyst with Northcoast Research Partners, covers the powersports sector within his consumer sector coverage list. Northcoast Research Partners is an institutional equity research firm located in Cleveland, Ohio.