Last month we explored the TBOC 2009 year-end numbers. This month we’ll look at how February 2010 compares with February 2009. I have shown the TBOC numbers for both years, as well as the comparable National Norms (NN) from our other groups. In some cases, the different reporting systems used by these 20-groups are not totally comparable. In those instances, I have entered "N/A."

Are things getting better? If some recent 20-group member e-mails are any indication, yes, they are improving for many dealers. This should be reflected in the coming month’s data comparisons.

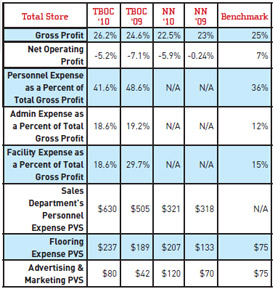

There are some improvements in the Total Store (Chart 1), particularly in the TBOC groups. However, these groups are still showing much higher personnel expenses than the National Norms groups. Conversely, the National Norms groups spent a lot more per unit to reduce inventory.

Chart 1

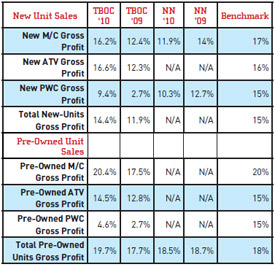

Chart 2 shows new and pre-owned unit margins improving significantly for TBOC members. Overall, pre-owned margins are very strong. I keep saying this is an area of opportunity for many dealers, and for good reason.

Chart 2

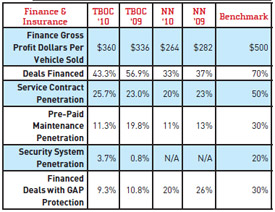

Although F&I numbers in Chart 3 are not what they were a few years ago, this is still an important profit center for our business. Note that finance penetration is still the issue. You need to approach your local credit unions if you haven’t already. They have money and are very aggressive in many markets. If they aren’t interested today, keep going back, as things change rapidly. Put together a good lender packet. You need to sell them on your business.

Chart 3

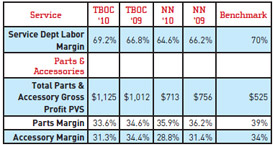

In Chart 4 you can see dealers are focused on improving their service margins. This needs to be run as a very tight ship in order to be profitable. P&A margins are slipping a bit. Some dealers are becoming more competitive with Internet prices, as they can’t afford to let people walk. Many dealers are using specially priced accessories and/or clothing packages as incentives for closing unit sales.

Chart 4

As I said last month, track your numbers, keep inventory and overhead under control, hire the right people and provide exceptional customer service. These are still the keys to success.

At GSA we track benchmarks through our involvement with dealer 20-groups. The TBOC data comes from the groups that are in the a real-time, web-based data reporting system. National Norms are compiled from the groups that report in the former-RPM data system.

Racer and Dealer Sponsorship Must Be a Two-Way Street

You’re better to have no racers than the wrong racers.

You’ve decided to sponsor a few local riders. There’s a motocross track nearby as well as a very twisty paved track and lots of off-road racing as well. I’m sure I’m not alone in having people of all ages wanting me to sponsor them. Usually, it’s someone who has done well locally — or thinks he or she will do well soon.

How to Respond to Digital Leads

Timing, presence and tools are all critical.

How to Attract, Retain and Develop Talent

This recorded AIMExpo education track features a panel of dealers discussing their hiring and retention practices.

How to Grow and Excel in Digital Retailing

This recorded AIMExpo education track discusses the world of digital retailing and why you need to be there.

NPA Pre-Owned Market Update: February 2024

Average wholesale prices continue to improve, reflecting dealer sentiment and demand for pre-owned.

Other Posts

Establishing the Right Pay Plan for Your Dealership’s F&I Team

In an industry where skilled F&I professionals are in high demand, an attractive, fair and equitable pay plan becomes a key tool.

Maximize Every Sale With F&I and PG&A

This recorded AIMExpo education track discusses how the bike is just the start of the sale.

Elevating Your Sales Game Through Parts Packaging

Breaking down the art and science of a well-designed, customer-focused, profit-friendly parts package.

Unleash Your Experts: How to Be a Long-Tail Resource for Powersports Enthusiasts

Closing deals and providing service are a dealer’s bread and butter, but your dealership has far more to offer.