This article contains actual dealer data obtained from GSA’s 20-group reporting system. 20-groups consist of dealers from non-competing markets who meet 3 times a year to share financial and best practice information. Their goal is to grow and improve their businesses profitably.

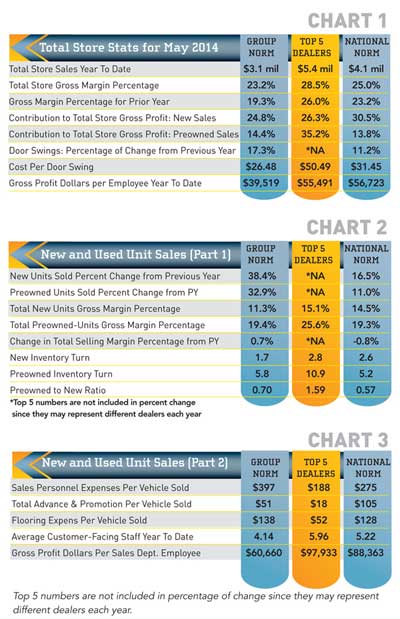

In Chart 1, total store gross margins are still light for this group while the Top 5 and National Norm dealers are hitting the benchmark of 25 percent. That said, the group’s margin is much better than last year at this time. The National Norm represents the average for all the dealers in the 20-group.

The contribution numbers are interesting. Overall, the group is getting about 40 percent of its gross profit from unit sales, which means the rest is coming from finance & insurance (F&I), parts & accessories (P&A) and service. The National Norm average is around 44 percent.

One of the facts we know is that during a recession, dealers who have a higher percentage of their gross profit coming in from P&A and service, suffer less impact. This is because they can still pay the bills even when unit sales are down. Something to keep in mind – don’t spend all your time focused on selling units only.

The Top 5 are making a lot of profit with preowned. If you doubt this, look at the preowned vs. new margins in the next set of numbers.

Part 1 shows decent increases in unit sales for the group, but not so much for the National Norm dealers (Chart 2). In margins, it looks like this group has some discounters in new units and both they and the National Norm dealers are leaving money on the table in their preowned deals. I was just in a store with a 1.7 preowned-to new ratio. They are very aggressive about buying bikes from the local riders, car dealers and auctions and they hold over 25 percent gross margins on these units. This is a real-world example of how to make good money in unit sales.

Turns are a critical measurement as well. You’ve got to buy the right product for your market and get it out the door quickly to hold down flooring and free up cash flow.

In Part 2 we find that the group is paying the most to employees to get their units sold (Chart 3). The Top 5 are paying less, and getting more ROI for it.

It would be interesting to explore the media each of these categories is using for promoting their businesses. The National Norm dealers are spending far more per unit than the stingy Top 5 or even the group dealers. According to all the statistical evidence, most of the traditional media is not working well except in a few selected market areas. In general, local events, social media, websites and emails are having a far more positive return.

Flooring costs are pretty high for the group and National Norm dealers, but keep in mind that many of the Top 5 dealers may pay cash for their inventory. They also turn it at a good rate. Both factors influence their flooring expenses.

As usual, there is quite a difference in the productivity of the staff for these dealer groups. The Top 5 pull in significantly more gross profit per employee. This indicates they probably have better quality salespeople and provide them with ongoing training.

So where do you stand in comparison to these figures?

Steve Jones, GSA senior projects manager, recaps critical measurements used by the leading 20-group dealers. Access to GSA’s Voyager 5 data analysis & comparison system is available for any dealership for a nominal fee. For more information on Voyager, management workshops, dealer 20-groups, on-site consulting or training, send an email to [email protected] or visit www.gartsutton.com.