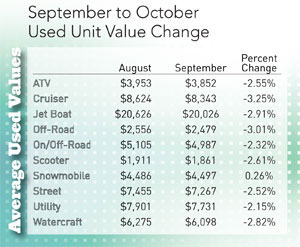

Just like last month, the powersports market continues to see decreases in value for almost all the segments covered, but they are less substantial this time around. This month’s drops are in line with normal seasonal trends; although it is still a very weak market overall, a continuing trend for most of 2013.

Just like last month, the powersports market continues to see decreases in value for almost all the segments covered, but they are less substantial this time around. This month’s drops are in line with normal seasonal trends; although it is still a very weak market overall, a continuing trend for most of 2013.

For road bikes, the street segment is down 2.5 percent, dual sports are down 2.3 percent and scooters are down 2.6 percent versus last month. Those percentage drops translate into about $188 for street bikes, $118 for dual sports and about $50 for scooters.

Domestic V-Twins, down around 4 to 4.5 percent, skew the overall cruiser segment average, which is down -3.3 percent.

In the off-road segments, bikes are down 3 percent, ATVs are down 2.6 percent and utility vehicles are down 2.2 percent. The ATV and utility vehicle segments were up slightly last month, but are now the two segments affecting the overall weakness in the market the most. The ATVs and the other utilities should both be increasing in value based on the time of year, but are not.

In the off-road segments, bikes are down 3 percent, ATVs are down 2.6 percent and utility vehicles are down 2.2 percent. The ATV and utility vehicle segments were up slightly last month, but are now the two segments affecting the overall weakness in the market the most. The ATVs and the other utilities should both be increasing in value based on the time of year, but are not.

As the year draws to a close and cooler weather approaches, the snowmobile segment should increase. Right now, that segment is increasing but by very small amounts; an average of only $11.46 per unit or a percentage increase of 0.26 percent.

The variability in pricing from one auction to another has increased in recent months. This is primarily a result of volume and mix consignment and having the right number of sincere buyers for the inventory offered. More specifically, the reduced volumes of 2009 to 2011 model years new units sold has led to reduced numbers of units available at all the auctions.