The 2008 recession took away consumer’s discretionary income and with it, the potential to afford luxuries, like a motorcycle purchase, the way they had in the past.[1] While eventually, the country regained its footing and motorcycle sales leveled out — they still haven’t gone back to what we saw before that 40% drop in 2008 – indicating a larger change in our industry.

We’ve heard it called the greying of our industry, and the data supports that trend. The average motorcyclist was 40 years old in 2009, but by 2018 — that number had risen to 50, so the demographic that has fueled our industry over the past twenty years is getting older and potentially aging out of the lifestyle.[2],[3] Instead of buying their first bike, they’re buying their last.

So, that begs the question — who is replacing these riders? In a perfect world, it would be the millennial generation, but they haven’t been buying bikes at the same rate as previous generations — and there’s the crux of our industry’s change. Younger riders just aren’t getting involved the same way their parents did, so it has left our industry, as a whole, to reevaluate how we can more effectively attract, engage and influence the new riders that are entering the market.

And that starts with understanding.

So, who is the new generation of buyers?

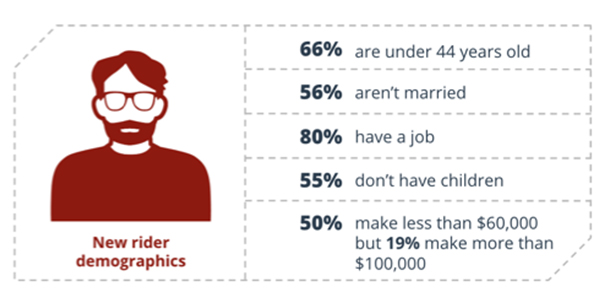

From a demographic perspective, these first-time buyers are young, unmarried and employed. The majority don’t have children and exactly half make less than $60,000 per year.[4] They are your quintessential millennials.

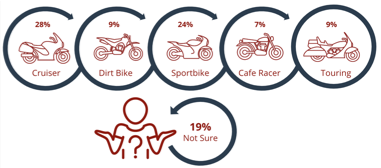

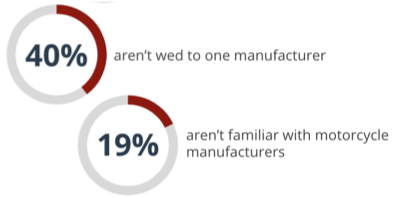

When it comes to buying their first bike – 20% of them aren’t even sure what type of bike they want to ride and are even less knowledgeable when it comes to which manufacturer might fit into their lifestyle and budget.4 This is an interesting change from current motorcycle riders, where 26% say that the manufacturer is the most important part of their purchase decision.[5] But new riders are just that – new — and many don’t necessarily come from a riding or powersports background, with 65% of saying they don’t have plans to ride with family, friends or a club and 70% saying they don’t own any other powersports units — so they don’t have a community they can turn to for advice on this big purchase.[4]

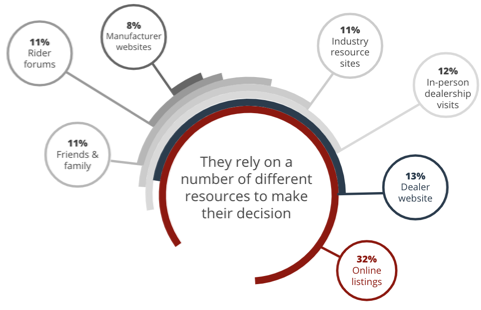

Since they are still trying to figure out what they want — they put time and effort into their research, with 44% spending over two months hunting for their perfect first bike.[4] They don’t necessarily have someone to ask directly for advice, so they turn online to check out marketplaces, rider forums, dealer websites and social media also plays a big role, with 62% of new riders turning to these platforms as a key part of their search.[4] This is a big purchase, possibly the first one they’ve ever made, so they want to make sure they have all the facts before showing up at your dealership.

So, if they’re brand agnostic and aren’t sure exactly what they want to ride — what is driving their purchase decision? Price is a big motivator, with 55% saying it is the number one thing they consider and 71% won’t even bother looking at listings that don’t include a price.[4] Interestingly, the vast majority of this audience, nearly 70%, say they aren’t planning to finance their bike, with 58% placing value on the final unit price, including taxes, title and fees, over the price on the tag or the potential monthly payment price.[4] They plan to pay upfront so they want to have a complete understanding of exactly how much cash they need to drive that bike off the lot.

But as a dealer, you’re still an important part of their path to purchase with 73% saying a dealership could change their mind about the unit they’re interested in. When these first-time buyers do reach out, they’re extremely eager, so attracting them is just half the battle. Once they’ve reached out, 53% say they want to hear back from a dealer the same business day and if you aren’t able to reach out to them in a timely manner, 55% say they will move on to another dealer within a few days, so that gives you a little lag time, but not much.[4] Behind competitive prices, buyers are looking for a friendly, knowledgeable staff, welcoming environment and a positive reputation. Remember, they are looking for someone to guide them through the buying process – and they want to work with someone they can trust as they decide on the right first bike for both their lifestyle and budget.

While this younger, first-time audience doesn’t yet make up as much of our industry as the Baby Boomers, they do account for over a quarter of motorcyclists in the market today, so the opportunity is there for our industry to continue to grow heading forward. It’s time for us, as an industry, to focus on understanding how this new generation is different from generations we’ve seen before and then adjust our marketing, products and materials to better cater to their needs.[4] Time will tell if sales will jump back to what we saw before the recession of 2008, but no matter where our industry’s headed, you can be sure these first-time riders will be leading the way.

Link: Cycle Trader

[2] https://www.fool.com/investing/2017/03/05/7-motorcycle-statistics-thatll-floor-you.aspx

[3] https://www.rideapart.com/articles/304226/mic-2018-stats-who-are-we/

[4] Cycle Trader Consumer Survey 2018

[5]Cycle Trader Consumer Survey 2016