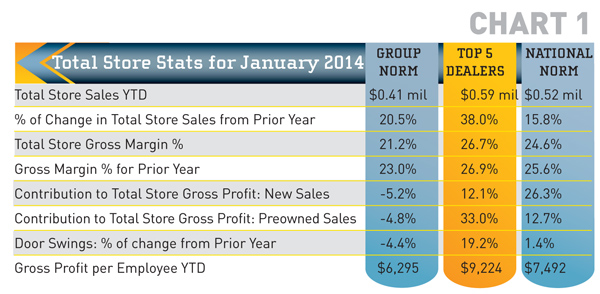

In looking at the Total Store Stats (Chart 1) we see that 2014 started off with a bang when compared with last year. There was a significant improvement in Total Sales dollars when compared with last year. Although not reported here, the net operating profit was up for the Top 5 and National Norm (NN) dealers as well.

However, overall store Gross Profit margins are down across the board (although only .2% for the Top 5 dealers). Unit sales’ contribution to Total Store Gross Profit for this group was very poor, perhaps indicating some serious “cleansing” of aged inventory. On the other side, the contribution was positive for everyone else. Notice the “flip” in contribution from new sales versus used sales between the Top 5 and NN dealers.

The Top 5 are continuing to concentrate on used sales because it produces more Gross Profit than new.

Door swings were down for this group and their Gross Profit dollars per employee was anemic when compared with the other dealers. The Top 5 had a decent increase in door swings vs. last year and pulled 32% more Gross Profit per person than the group – which is pretty significant.

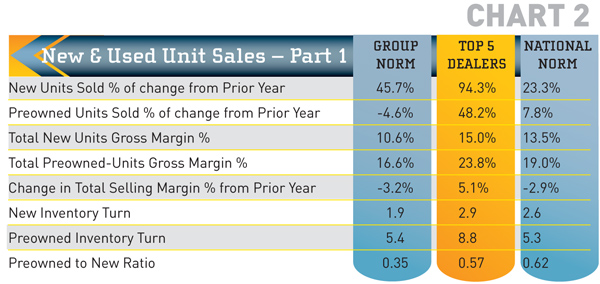

Part 1 (Chart 2) shows an increase in new unit sales across the board, but the Top 5 rocked the house with their 94% of change. In addition, they blew out the others with their used sales increase.

The 10% new margin average and -3% change in selling margin for the group is another indicator that they were dumping inventory this January. The Top 5 outsold them with 5% more profit. Speaking of margins, look at the 23.8% the Top 5 gets out of used units. It’s no wonder why they keep attacking this business with such enthusiasm.

Inventory turns are calculated over 12 months and reflect the slower selling seasonality at this time of year. Still, the Top 5 managed almost nine turns of their preowned units. Cool, huh?

One surprise is the NN 0.6 preowned-to-new ratio for January. That’s just over one preowned sold for every two new units. Good job, folks. Now work on keeping it up for the rest of the year.

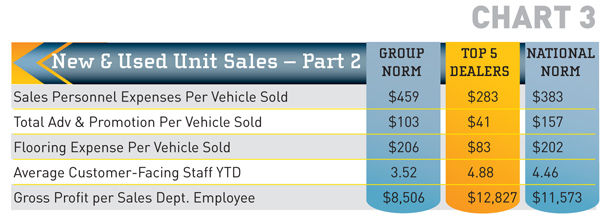

In Part 2 (Chart 2) we find that this group is struggling with expenses. They have high costs Per Vehicle Sold across the board for January. This has to be resolved quickly. Meanwhile, the Top 5 are running a tight ship. Their inventory turns (combined with wise stocking levels) have helped them keep flooring costs at less than half of the group and NN dealers.

Despite more staff, they are managing more Gross Profit dollars per person in Sales as well as in the overall dealership. This reflects their ability to hire the right people and provide them with quality training leading to increased productivity. You are often wiser to pay more to acquire or retain high-quality people – as long as they produce better results.

Have questions? Feel free to contact me for information, explanation or to discuss how GSA can help you grow your business profitably.

Steve Jones, GSA senior projects manager, outlines dealership best business practices to boost margins, increase profitability and retain employees. His monthly column recaps critical measurements used by the leading 20-group dealers. GSA is recognized as the industry’s #1 authority on dealer profitability.

Access to the Voyager 5 data reporting and analysis system is available for any dealership for nominal fee. For more information on GSA’s data reporting system, management workshops, dealer 20-groups, on-site consulting or training, send Steve an email at [email protected] or visit www.gartsutton.com.