In this article, we’re going to look at June 2012 performance data from the sales departments of our 20-group members. We’ll compare one of our metric 20-groups against the National Norm numbers (overall averages for all our metric 20-groups) and the average of the Top 5 performing dealers in each category.

In this article, we’re going to look at June 2012 performance data from the sales departments of our 20-group members. We’ll compare one of our metric 20-groups against the National Norm numbers (overall averages for all our metric 20-groups) and the average of the Top 5 performing dealers in each category.

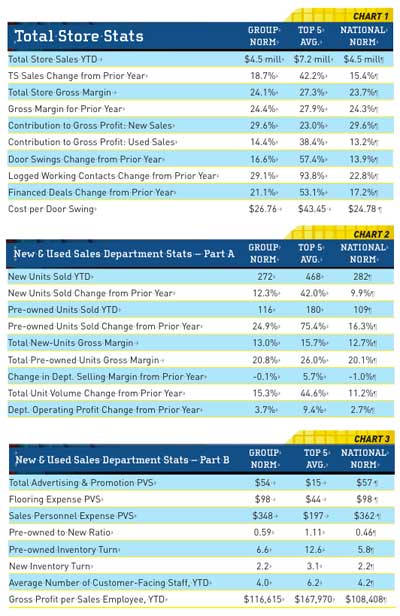

I always like to include a snapshot of some pertinent numbers for the overall store. This helps set the stage for the individual department data.

In looking at the Total Store Stats, you can see that the average dealer size for both this group and the National Norm dealers sold around 4.5 million through the end of June. The Top 5 dealers did just over 7 million in total sales during the same period.

While total store sales dollars increased nicely for the group and the National Norm dealers, the sharp operators in the Top 5 continued to exceed industry averages considerably. They excelled in maintaining higher gross margins while doing this. They also continued to increase door swings — up over 57 percent from last year! As you can see, they paid more for them, but they got a good return from the investment. It was worth it. More importantly, they are obviously capturing the customer’s information so they can follow up. They undoubtedly have a prospecting process based around the log. Do you?

While the group and the National Norm dealers are increasing their percentage of financed deals, the Top 5 have increased much more here as well. Capturing the financing is critical to capturing the add-on sales of F&I products, and it can also heavily influence accessories sales.

Check out the numbers for unit sales. The group and National Norm dealers are averaging around 280 units through June. The Top 5 average is 468. While there were healthy increases in both new and used sales, you can see all the dealers are getting more aggressive about used. This is where the unit sales profit is, folks. The Top 5 dealers are amazing in their ability to acquire used product and get it sold.

Look at the difference in the unit sales margins for the Top 5 dealers versus the group and National Norm numbers. These are not your big-volume discount houses — these dealers work hard to grow volume while maintaining exceptional profitability. If you’ve ever been told this can’t be done, read the statistics. Show them to your dealer friends who still insist you can’t sell volume while holding margins. This kind of profitability requires dedicated, hard-working managers with a well-trained staff that’s being held accountable for its results.

Part B of our new and used sales department stats shows us key expense per vehicle sold (PVS) and other significant sales department stats. The Top 5 manage to get more customers though the door, while spending less on advertising PVS. They are making better use of non-traditional media by doing things like working shows and events or getting involved with community promotions and charities. I can almost guarantee that they are investing time and effort into social media.

The group and National Norm dealers are selling around one used unit to every two new units, while the Top 5 are doing better than one for one. They are also turning them twice as fast. It is interesting to note that they are doing this with only slightly more people. I would bet they are all “A” quality folks. It pays to hire the best you can. How many of you are holding on to people who are costing you sales (and profits) instead of making sales? Look at the personnel expenses —Top 5 dealers are doing it for $150 less PVS than the other dealers.

The last number is a real good measurement that can be compared by all sizes of dealers. This is what it boils down to when looking at your personnel. When all is said and done, how much gross profit is your staff making for your dealership?

Take a purely analytical look at the performance of the sales department in your dealership. Compare your data with the numbers provided in this column. What does your store look like in comparison? As always, feel free to contact me for information, explanation or to discuss how GSA can help grow your business profitably.