Off-road vehicles market to register 4.8% growth during 2018 to 2027.

Upsurge in the recreational and sports activities across the world is anticipated to propel off-road vehicles market over the forecast period. Increasing urban population coupled with a growing youth inclination towards motorsports activities will augment product penetration across the globe. Countries including the U.S, Canada, UK, France and Australia are taking initiatives to flourish outdoor activities such as hunting and trail driving.

The U.S. Recreation Department offers over 150,000 miles of trails and around 440 wilderness areas, attracting participants, thereby augmenting the off-road vehicles market share from 2018 to 2027.

Augmented fuel efficiency, reduced carbon emissions, advent electric powered alternatives and subordinate maintenance costs of off-road vehicles will fortify the product demand over the forecast period.

Diversified applications including utility, sports, recreation and military activities, due to their superior technical benefits comprising advanced four-wheel drive systems, enhanced power and torque and differential locking will boost the off-road vehicles market share over the forecast period. Progressions in technologies comprising the prominence on decreasing the excessive sound from the engines of the off-road vehicles will drive the off-road vehicles market share over the forecast period.

For instance, in 2015, Polaris begun work on its hybrid off-road vehicle, Hybrid Utility Vehicle based on the Polaris MRZR 4 with superior noise damping capabilities and amplified power. Progress of hybrid engines with upgraded efficiency and negligible emissions accompanied by the introduction of light weight models will further encourage the industry growth until 2027.

This report assesses trends that are driving the growth of each segment on the global level and offers potential takeaways that could prove substantially useful to off-road vehicles manufacturers looking to enter the market. Main regions assessed in this report include North America, Latin America, Europe, Japan, Asia Pacific excluding Japan (APEJ), and the Middle East & Africa (MEA).

The sections, by vehicle type, by fuel and by the application in the off-road vehicles market evaluate the present scenario as well as growth prospects of the regional off-road vehicles market for 2018–2027. The North America off-road vehicle market has been estimated to dominate by value owing to the high cost and growing demand, accounting for a maximum revenue share of the market by 2018 end. Europe and APEJ off-road vehicles markets are expected to account for over 40% collaborative revenue share, of the global off-road vehicles market by 2027 end. Among the emerging markets, the APEJ off-road vehicle market is estimated to exhibit a significant CAGR of more than 5.0% over the forecast period, followed by North America with a CAGR of about 4.0%.

To provide in-depth insights into the pattern of demand for the off-road vehicles market, the market is segmented by vehicle type. It includes all-terrain vehicles (ATV), side-by-side vehicles (SSV), off-road motorcycles and snowmobiles. The side-by-side vehicle segment is expected to dominate the off-road vehicle market over the forecast period, regarding value, which accounted for more than 40% value share in 2027.

The section – Off-Road Vehicles market analysis, by fuel comprehensively analyzes the market by fuel used in off-road vehicles. The market is segmented into diesel, electric and gasoline. The segment, diesel in an off-road vehicles market accounted for the highest market share of more than 60% in 2017. The segment electric is expected to grow remarkably over the forecast period.

The section – off-road vehicles market analysis, by application comprehensively analyzes the market by different applications where the off-road vehicles are utilized. The market is segmented into utility, sports, recreation and military. Sports segment accounted for the highest market share in 2017. However, the recreation segment is expected to register a healthy CAGR of more than 5% during the forecast period due to the increase in recreational activities across the developing economies.

Also, increasing demand for off-road vehicles in the APEJ region is driving the prominent manufacturers to strategically enter in the APEJ market with an objective to target the opportunities in the region. The off-road vehicles market in North America and Europe region has matured, and hence, the companies are targeting emerging markets to increase their sales revenues.

APEJ Region Critical in the Off-Road Vehicles Market

The APEJ region is estimated to account for more than 20% market share in the global off-road vehicles market in 2018, and this share is expected to grow by a massive rate, causing the APEJ market to grab more than 25% market share by the end of 2027. Growing off-road activities and increasing preference for off-road motorcycling and dirt bike events are amongst the major aspects subsidizing to the regional growth. Sports events organized by the International Automobile Federation Asia will further propel the regional dominance over the forecasted period.

Global Off-Road Vehicles Market: Competition Dashboard

The study has profiled some of the most prominent company’s active in the global off-road vehicles market such as Arctic Cat Inc., Honda Motor Co. Ltd., Deere & Company, Kawasaki Motors Corp., Kubota Corporation, Polaris Industries Inc., Suzuki Motors Corporation, Yahama Motor Co., Ltd., Bombardier Recreational Products, Kässbohrer Geländefahrzeug, Textron Specialized Vehicles Inc., Wildcat Automotive, Massimo Motor Sports, LLC., KTM AG and Mahindra & Mahindra Ltd.

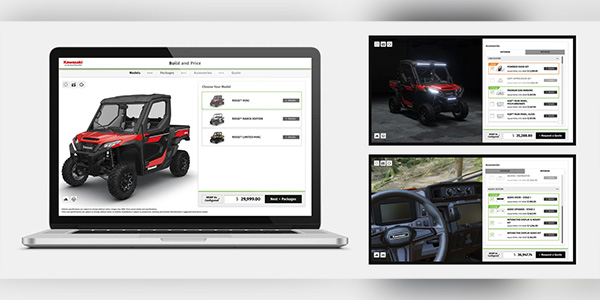

The key market players in the off-road vehicles market are focusing on product development and collaboration. Vendors in the off-road vehicles market are focusing on developing technological advanced and innovative solutions that can meet the changing customer requirements. Recently, in 2018, Polaris Industries Inc. launched advanced 2019 product line-up of their off-road vehicles including the RANGER, RZR, GENERAL and Sportsman series. These models with diversified configurations includes exclusive half doors, water drains, enhanced suspension drive for smooth drive, electronic power steering, bronze tires and varied power outputs ranging from 82 to 100 horsepower will outfit in multiple price ranges, enhancing their market share over the forecast period.

Global Off-Road Vehicles Market: Key Insights

The off-road vehicles market has grown consistently at a CAGR of 4.8%, and the market has been expanding at a gradual pace. The vendors in the off-road vehicles market are focusing on product development companies that provide Off-road vehicles and gain a competitive edge in the market by providing diversified product categories.

These insights are based on a report on Off-Road Vehicles Market by Fact.MR.