ARI Network Services, a provider of website, software and data solutions for dealers, distributors and manufacturers, reported its fiscal fourth quarter and fiscal year (ended July 31, 2013) financial results today.

Highlights for the fiscal fourth quarter included:

Revenues for the fourth quarter of fiscal year 2013 were $8.5 million, a 44 percent increase over the same period last year.

Recurring revenues for the fourth quarter of fiscal year 2013 were $7.9 million, a 65.1 percent increase over the fourth quarter of fiscal year 2012. As a percentage of total revenues, recurring revenues in the fourth quarter were 93.6 percent in fiscal year 2013 versus 81.7 percent for the same period in fiscal year 2012.

EBITDA, a non-GAAP measure, adjusted for non-cash charges, was $1.5 million in the fourth quarter, an increase of 36.4 percent over the same period last year.

Highlights for the fiscal year 2013 included:

The company reported record revenues of $30.1 million, a 33.8 percent increase over fiscal year 2012.

Recurring revenues for the fiscal year 2013 were $27 million, a 44.3 percent increase over fiscal year 2012. As a percentage of total revenues, recurring revenues were 89.7 percent in fiscal year 2013 versus 83.2 percent in fiscal year 2012.

EBITDA, a non-GAAP measure, adjusted for non-cash charges, was $3.5 million in fiscal year 2013, a decline of 19.5 percent from fiscal year 2012, which was related to costs associated with the two fiscal year 2013 acquisitions.

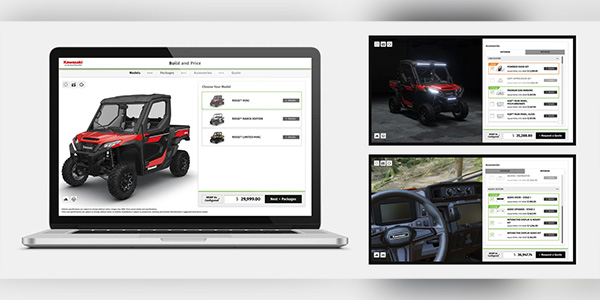

On August 17, 2012, the company acquired substantially all of the assets of Ready2Ride, Inc., the first-to-market and leading provider of aftermarket fitment data to the powersports industry. The Company leveraged this data in its February 2013 release of AccessorySmart, a fitment driven parts lookup solution, which won a Nifty 50 Award at the powersports industry’s largest trade show.

On November 28, 2012, the company acquired the assets of the retail division of 50 Below Sales & Marketing, Inc., a leading provider of eCommerce websites to the powersports, automotive tire and wheel and durable medical equipment industries. The 50 Below operation, which was purchased out of bankruptcy, is already generating positive cash flow.

On March 13, 2013, the company announced that it entered into agreements with various accredited investors in a private placement of 3.2 million shares ($4.8 million) of its common stock at a purchase price of $1.50 per share. The company also issued warrants to purchase 1.1 million shares, all but 214,000 of which have been exercised to date. The funds raised in the private placement were used to pay down a substantial portion of the company’s outstanding debt.

On April 25, 2013, the company announced that it closed new senior secured credit facilities with Silicon Valley Bank. The facilities include a $4.5 million term loan and a $3 million revolving credit facility. The proceeds from the transaction were used to pay down the remaining portion of the Company’s outstanding debt with Fifth Third Bank and with a shareholder.

Fiscal Year 2013 Financials

ARI reported revenues of $30.1 million for fiscal year 2013 versus $22.5 million for fiscal year 2012, an increase of 33.8 percent. Recurring revenue comprised 89.7 percent of total revenue during fiscal year 2013 versus 83.2 percent in fiscal year 2012. The increase in revenues was driven by the company’s November 2012 acquisition of the assets of the retail division of 50 Below Sales & Marketing, Inc.

Overall gross margin for fiscal year 2013 was 78 percent, versus 76.6 percent last year. The gross margin improvement resulted from the company’s focus on higher margin, recurring revenue streams and its continued shift away from one-time revenue sources.

The company incurred a net loss of $753,000 or ($0.08) per share for the year, compared to net income of $1,055,000 or $0.13 per share last year. The loss incurred in fiscal 2013 was driven by acquisition-related costs of approximately $1,200,000, a non-cash loss on the fair market valuation of stock warrants of $635,000, a non-cash loss of $682,000 related to the early repayment of debt and a $420,000 non-cash impairment charge to a long-lived asset. These charges were offset in part by a non-cash gain recognized on a change in estimate of contingent liabilities of $180,000 and an income tax benefit of $1,133,000.

Management Discussion

Roy W. Olivier, president and chief executive officer of ARI, commented, “Fiscal 2013 was a transformational year for ARI. We completed two acquisitions, which provided us with a first-to-market opportunity in the powersports industry and introduced ARI to several new markets — aftermarket wheel and tire and durable medical equipment. We raised $4.5 million in a private placement transaction that was used to reduce our post-acquisition debt and are excited about our new relationship with Silicon Valley Bank, which we believe will be a critical growth partner for the company.”

Mr. Olivier continued, “Our acquisition of 50 Below in November 2012 was a game changer for ARI. We posted record revenues in fiscal 2013, exceeding $30 million for the first time in the Company’s history and now host and maintain more than 5,500 websites. ARI has proven time and time again that it is highly capable of acquiring and efficiently integrating companies. The 50 Below operation, which we acquired out of bankruptcy in November 2012, recorded an operating loss of $3.4 million on revenues of $9.2 million for the trailing twelve months ended October 31, 2012. By the quarter ended April 30, 2013, we had already achieved positive cash flow and EBITDA for 50 Below, ahead of our original expectations.”

Darin Janecek, chief financial officer of ARI, commented, “ARI’s overall profitability was affected in fiscal year 2013 as a result of the one-time acquisition-related costs and other non-cash charges. Excluding these charges, ARI generated adjusted EBITDA of $1.5 million in the fourth fiscal quarter; it’s the first quarter since the acquisitions of both Ready2Ride and 50 Below of year over year EBITDA growth, an indication that we are successfully integrating the acquisitions. Further, we continued to improve on two of our most important growth metrics — recurring revenue and churn. Recurring revenues exceeded 90 percent of total revenue in the fourth fiscal quarter and our overall rate of churn improved to 12.8 percent in fiscal year 2013 versus 13.4 percent last year. The private placement and Silicon Valley Bank financing transactions enabled us to improve our balance sheet substantially following the two acquisitions, leaving us poised for continued growth as we head into fiscal 2014.”