At GSA we track current industry benchmark data through our real-time dealer 20-group data reporting analysis and comparison system. This month, we’ll look at actual November data compiled from one of our groups.

At GSA we track current industry benchmark data through our real-time dealer 20-group data reporting analysis and comparison system. This month, we’ll look at actual November data compiled from one of our groups.

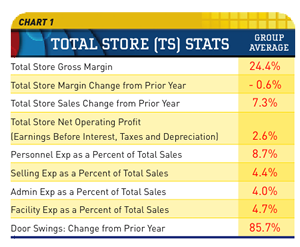

The 24.4 percent total store gross profit margin for this group is just short of the benchmark of 25 percent; however, the TBOC (top performers) number is at 27 percent. This is a real improvement and validates the slow upward trend we’ve seen in the better groups this year. Total store sales increased more than 7 percent, and door swings are up over 85 percent compared with last year. Their net is small, but positive — TBOC net operating profit is at 4.8 percent.

The dealers have made some small improvements in expenses. The expense-to-income ratio is the whole ballgame for most dealers. You need to continue to cut non-essential costs wherever possible. At the same time, you must maintain staffing for quality customer service. This is a fine line in many cases.

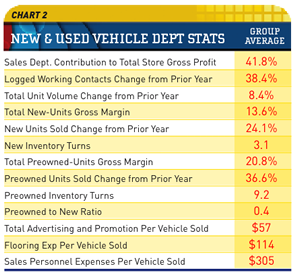

Chart 2 shows more positive indicators. The sales department contribution is up two points from October. Working contacts are up almost 40 percent. New unit sales are up 24 percent and preowned sales are up 37 percent. New margins have dropped a bit. However, the TBOC is at 15.8 percent. Work every deal for every dollar. Sell instead of resorting to price. Build value. Remember, product availability is decreasing rapidly.

Preowned margins are around 21 percent, and the TBOC average is 23 percent. Look at the number of turns — this is where the best profits are to be made in the sales department. If you have the cash, now is the time to buy preowned inventory at the right price.

Flooring expense per vehicle sold dropped from $132 last month to $114 this month; TBOC is at $97. This is good news as we go into the slower months.

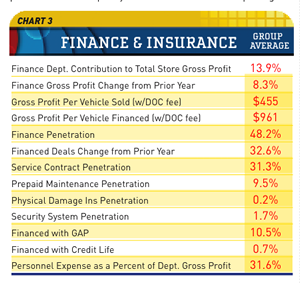

F&I gross profit margins (Chart 3) are still improving; finance penetration is up to almost 50 percent. This is a 32.6 percent improvement from last year and is up 6 percent from last month. Service contracts, GAP and pre-paid maintenance are still the major areas of focus.

It is important to recognize that for every F&I product there is a customer who may benefit from purchasing it. Not presenting every product to every customer is doing them a disservice. At least let them know what you have, describe the benefits and let them make the choice.

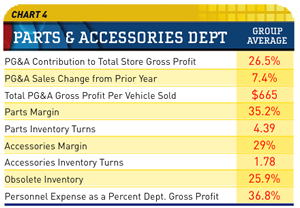

In Chart 4, there are some sales improvements since last year. Parts margins have dropped slightly, but TBOC is holding 37.8 percent. Some disturbing trends are the reduction in accessory turns and the increase in obsolescence (no sales for 12 months). 26 percent is too high, and these dealers will need to take fast action to turn these dollars into products that move quickly. One rule I heard from a dealer is “retail it, wholesale it, eBay it, donate it or dumpster it.”

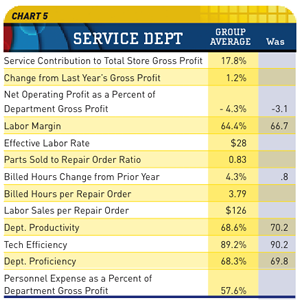

The service department (Chart 5) is still struggling. Profits are up a lowly 1.2 percent, and net operating has dropped from –3.1 percent to a –4.3 percent. The labor margin, which needs to be around 70 percent, has gone from 66.7 percent last month to 64.4 percent this month. This is not a good trend.

Most of the problems are visible when you look at productivity, which is at 68.6 percent ( it should be 85 percent), and efficiency, which is at 89.2 percent (it should be 100% or better), resulting in proficiency at 68.3 percent. All of these have decreased from last month. The service department must be very well managed if it is to produce a profit. These numbers could be a result of poor tracking of time such as not reporting all tech labor on repair orders or not using a time clock on the actual work hours per repair. Regardless, it needs to be addressed – and soon.

If you don’t know where you need to go, it is very hard to get there. Compare your dealership’s performance to these numbers. Make an effort to understand every aspect of your business and how it is performing in relation to the better dealers. If you have any questions, please feel free to contact me.

Note: Our Voyager 4 data reporting and analysis system is available for any dealership to use for a very nominal fee. For more information on our data reporting system, dealer 20-groups, on-site consulting or training, drop me an email at [email protected] or visit www.gartsutton.com.

At GSA we track current powersports dealer benchmarks through our involvement with our dealer 20-groups. The data comes from reports compiled from the dealers’ input into our real-time, web-based data reporting system.

Steve Jones, GSA senior projects manager, outlines dealership best business practices to boost margins, increase profitability and retain employees. His monthly column recaps critical measurements used by the leading 20-group dealers. GSA is recognized as the industry’s #1 authority on dealer profitability.