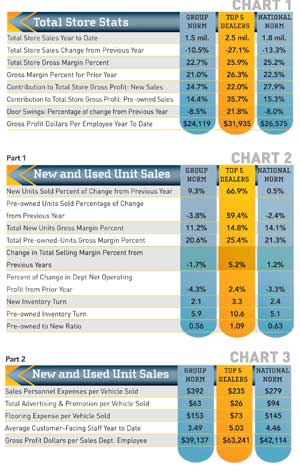

We’ll be comparing March data from a good-performing metric 20-group with the national norm numbers and the averages for the Top 5 dealers for this group in each category.

We’ll be comparing March data from a good-performing metric 20-group with the national norm numbers and the averages for the Top 5 dealers for this group in each category.

Hmm … total store sales are down from last year through March. As you will see below, this is not attributed to unit sales. The overall sales decrease came primarily from the parts and service departments. This may be a result of fewer folks repairing and updating older units as the economy continues to improve.

Total store gross margins were still anemic for this group — short of the target of 25 percent. However, the margin was up from 2012 for the group and the National Norm. The Top 5 dealer average dropped slightly, but it is still strong at 26 percent.

Part 1 shows us that new unit sales were up for the group and way up for the Top 5 dealers, but margins remained flat. Pre-owned sales dropped for the group members and the national norm, but increased considerably for the Top 5. These dealers are continuing to focus on the pre-owned portion of their business. If you question why, just look at the margins dealers hold with pre-owned as compared with new. Gross profit is what pays the bills, folks. This shows up in the Net Operating Profit (NOP). The Top 5 gained, the rest decreased.

The other place we see the advantage of pre-owned is in the number of turns. If you make a $5,000 profit on a given item and it turns twice in a given period, you have $10,000 in your pocket. If it turns six times, however, you have $30,000 and you’ll have to find a bigger wallet!

The pre-owned to new ratio indicates that the group and national norm dealers are selling a little over one pre-owned to every two new. The Top 5 dealers are selling one-for-one. It’s all about the profitability.

Part 2 provides you with some great benchmarks to compare yourself with, regardless of your size. Per vehicle sold is the great equalizer. This chart shows the relationship of personnel, advertising and flooring expenses to units sold. It also gives you an idea of the level of staff these dealers carry. They should all ramp up their sales staff at this point in preparation for the main selling season in most markets.

Gross profit per employee is another of these equalizer numbers. These numbers are valid for any size dealership.

The old cliché, “You can’t manage it if you can’t measure it,” is absolutely true. You can’t tell if the new processes you implemented made a positive improvement unless you have baseline measurements for comparison. You can’t hold staff accountable for performance unless you can measure that performance. I strongly encourage you to use these numbers to help you target areas for improvement in your own dealership.

Steve Jones, GSA senior projects manager, outlines dealerships’ best business practices to boost margins, increase profitability and retain employees. His monthly column recaps critical measurements used by the leading 20-group dealers. Access to the new Voyager 5 data reporting and analysis system is available to any dealership for nominal fee. For more information on GSA’s management workshops, data reporting system, dealer 20-groups, on-site consulting or training, send Steve an email at [email protected] or visit www.gart-sutton.com.