Last month, we looked at the June numbers. This month, we’ll see how July 2010 YTD stacks up when compared with 2009. These charts represent data averages compiled from top-performing members in selected groups.

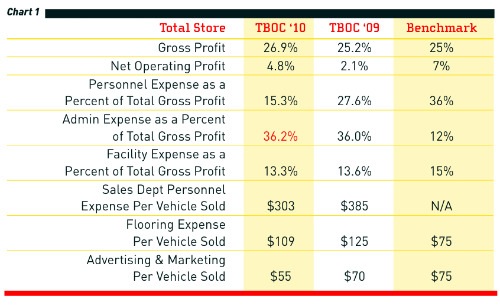

Chart 1: I’m pleased to report that total store gross profit is continuing to improve. More importantly, Net Operating Profit is also up. I won’t go so far as to say this is a turn-around in the powersports business, but it certainly shows an improvement in the health of these dealers. Part of the reason is revealed in the decrease in expenses as a percent of gross profit. It took a long time for dealers to get control of the expenses versus income ratio. It is not an easy task. Just cutting staff doesn’t do the job. You still have to have enough of the right people to run your business productively while providing a quality customer experience and good follow-up.

The improvement in flooring expense is a result of controlling inventory (in some cases a shortage of product). The drop in advertising and marketing per vehicle shouldn’t come as a surprise. I attribute much of this to the use of non-traditional media. Most dealers aren’t spending money on Yellow Pages ads. There also has been a reduction in advertising with newspapers, TV and radio. Instead, dealers are turning to a combination of community events and promotions, email marketing and increased social media involvement to drive customer traffic.

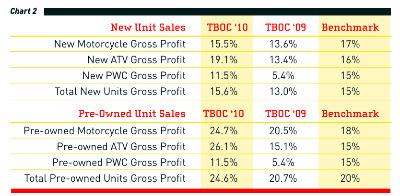

Chart 2: All I can say is outstanding! Dealers are implementing the processes necessary to increase and maintain margins. Gross Profit pays the bills. Many dealers have order-takers on their floors instead of salespeople. Enforcing the use of a structured selling process, using a worksheet and desking the deals to control profitability is critical here. This is what we call blocking and tackling — basic stuff that works. As product availability becomes tighter, these numbers should rise even more.

Look at the pre-owned margins — these are really impressive. This will only improve as dealers run low on new product. If you are not a player in pre-owned, you need to get your act together — now! Learn the local market values; establish sources where you can get units — trade-ins, auctions, OE sales, other dealers, auto dealers or even from classified ads.

How do you establish the trade-in value? Determine market value, deduct your desired margin and reconditioning costs, and you will have your trade-in or purchase value. Always use an appraisal form to justify your price. This will also help protect your dealership and your customer from misunderstandings.

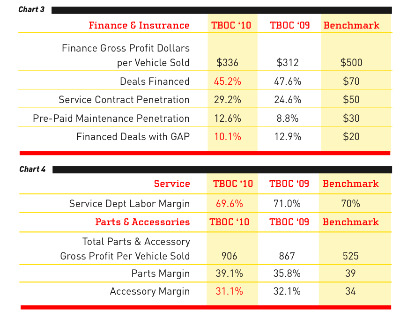

Chart 3: Finance gross profit dollars are slowly rising again, but the percent of units financed is down. Banks are still sitting on our money that the government graciously gave them. There are some opportunities available for financing with credit unions. Prepare a professional packet on your dealership and your customers and have a sit-down with the branch manager. Once you establish a relationship, make the effort to maintain it. Don’t put all your eggs in one basket — you need multiple finance sources.

One of the big mistakes I see in dealerships is a lack of conversion attempts. When you have a cash buyer, or one who says they will get the money from their bank or credit union, your sales/F&I people need to make the effort to try to convert them to dealership financing. This increases the potential for add-on sales and builds the relationship with your customer.

Work on your service contract penetration. I’ve seen dealers with well over 50 percent penetration in this area. I see that pre-paid maintenance is coming back in favor. The big deal with this product is to remember the purpose — it is to drive customers back into your store, not to grab the reserve funds because they don’t use the program. If they aren’t using the program, you need to find out why. You need the floor traffic.

Chart 4: Service margins are still close to that 70 percent goal benchmark. This is essential for covering the bills in this department. Be open about sharing these numbers with your service staff. They need to understand how tight it is to make a profit here.

P&A gross profit per vehicle sold is continuing to rise. This is an easy measurement for your dealership to use. Are you close to this mark? Why not? Are your P&A people just hanging behind the counter, or are they on the floor improving displays, stocking and rearranging merchandise and working with the customers?

Dealers are tightening up on their discounts on hard parts, and it shows. Accessories are still a bit of struggle due to Internet marketing, but there are ways to make it better. Be sure your customers are aware that they can order online from your store. They don’t have to go to third party suppliers. Moreover, you have live returns available.