Some dealers concerned about broader weakness

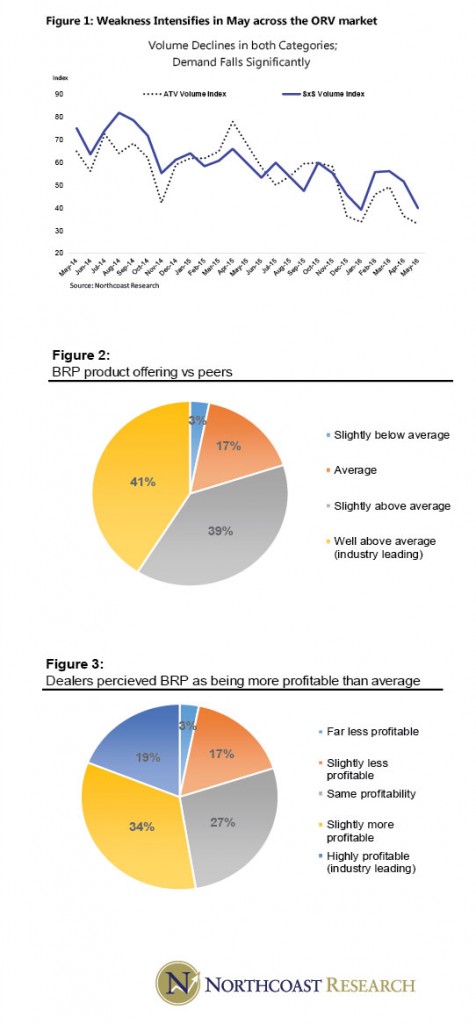

[dropcap]A[/dropcap]ccording to our latest research in the Off-Road Vehicles market, the slowdown that dealers reported in April magnified last month as survey respondents noted that the weakness accelerated. While it appears that weather was a modest headwind early in the month, we would note that it does not appear to have been nearly the sales detriment that dealers experienced in April. Thus, some contacts have expressed concern about the implications of the current weakness (e.g., it could be reflective of a broader slowdown as opposed to weather-related noise).

[dropcap]A[/dropcap]ccording to our latest research in the Off-Road Vehicles market, the slowdown that dealers reported in April magnified last month as survey respondents noted that the weakness accelerated. While it appears that weather was a modest headwind early in the month, we would note that it does not appear to have been nearly the sales detriment that dealers experienced in April. Thus, some contacts have expressed concern about the implications of the current weakness (e.g., it could be reflective of a broader slowdown as opposed to weather-related noise).

We believe that utility UTVs were the strongest, followed by recreation UTVs and ATVs. We would also add that the recreational UTV segment was still being pressured by the impact of the RZR recall in April. In light of the soft trends, dealers were very promotional as they attempted to ensure that they do not get caught with too much inventory if the soft demand trends intensify.

The general outlook of powersports dealers for the next three months was much more sanguine than in the past on account of the recent weakness they have seen in their business. That said, there was some anecdotal commentary that traffic trends improved modestly near the end of the month and in the early part of June.

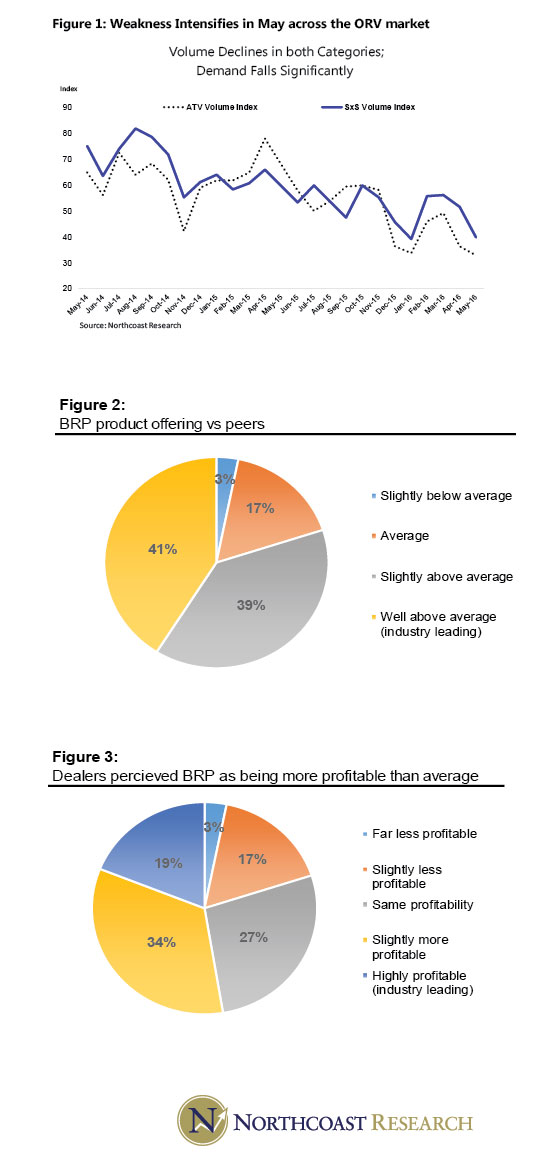

The biggest takeaway from our recent conversations with dealers is that their profitability (or lack thereof) has become a major problem. As such, we believe that as dealers begin to formalize their initial ordering plans for MY17 models, they will put more weight into the profitability of the units they stock than in the recent past. Accordingly, it will be interesting to see if/how this could change the landscape

in the near future.

Seth Woolf, a research analyst with Northcoast Research Partners, covers the powersports sector within his consumer sector coverage list. Northcoast Research Partners is an institutional equity research firm located in Cleveland, Ohio.