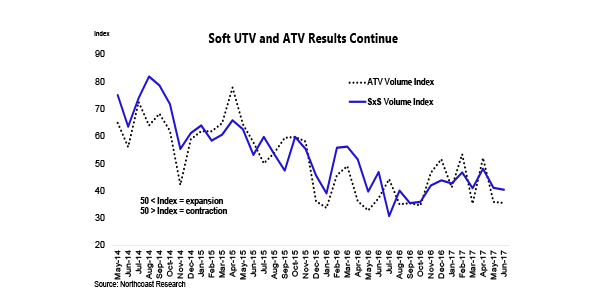

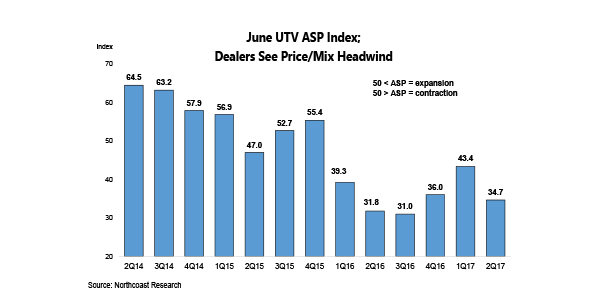

Our latest survey of powersports dealers indicates that the off-road vehicle market remained mixed as the retail sales environment improved sequentially for UTVs in June, while ATV demand deteriorated sequentially. Aside from unique new products, dealers continue to report that aggressive pricing is the primary driver of new unit sales. In our opinion, the intensity of promotions across the UTV universe has caused the UTV/ATV price gap to narrow to never-before-seen levels, which is driving incremental cannibalization to the UTV market.

Our latest survey of powersports dealers indicates that the off-road vehicle market remained mixed as the retail sales environment improved sequentially for UTVs in June, while ATV demand deteriorated sequentially. Aside from unique new products, dealers continue to report that aggressive pricing is the primary driver of new unit sales. In our opinion, the intensity of promotions across the UTV universe has caused the UTV/ATV price gap to narrow to never-before-seen levels, which is driving incremental cannibalization to the UTV market.

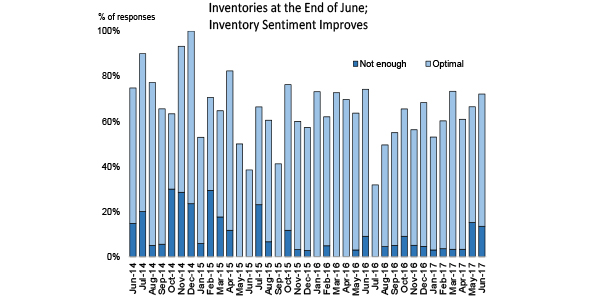

Price points aside, the UTV market continues to be driven by innovation, which is why Can-Am has been capturing so much share over the last year – something that we suspect will continue if the OEM can produce enough in 2H17 (something that dealers feel better about this month). On the topic of innovation, many discussions last month centered around the upcoming Polaris dealer event, where the company will have a chance to strike back with new products aimed to restore its dominance in the marketplace.

In the heavyweight motorcycle market, dealerships saw weakness in the month of June. While our conversations with H-D dealers suggest that carryover inventory has been drastically reduced from May; the talk has now shifted to the difficulty of selling the new, fully priced, Milwaukee-Eight-powered touring bikes. Clearly this is a sharp contrast to the talk earlier in the year when many dealers felt retail would be stronger on the back of a greater supply of Milwaukee-Eight-powered units. This begs the question: what is wrong with the market? Indeed, the U.S. heavyweight motorcycle market has now seen declines in six of the last seven quarters, which makes H-D’s new models more crucial than ever (slated for release in August).

In the heavyweight motorcycle market, dealerships saw weakness in the month of June. While our conversations with H-D dealers suggest that carryover inventory has been drastically reduced from May; the talk has now shifted to the difficulty of selling the new, fully priced, Milwaukee-Eight-powered touring bikes. Clearly this is a sharp contrast to the talk earlier in the year when many dealers felt retail would be stronger on the back of a greater supply of Milwaukee-Eight-powered units. This begs the question: what is wrong with the market? Indeed, the U.S. heavyweight motorcycle market has now seen declines in six of the last seven quarters, which makes H-D’s new models more crucial than ever (slated for release in August).

Seth Woolf, a research analyst with Northcoast Research Partners, covers the powersports sector within his consumer sector coverage list. Northcoast Research Partners is an institutional equity research firm located in Cleveland, Ohio.

Seth Woolf, a research analyst with Northcoast Research Partners, covers the powersports sector within his consumer sector coverage list. Northcoast Research Partners is an institutional equity research firm located in Cleveland, Ohio.

For a complete copy of Seth’s research this month, download the PDF at http://bit.ly/2w7vXfe.