This month I want to explore the changes we’ ve observed with our 20-groups due to the economic conditions. First, I have to say that we have never seen so much interest in 20-groups. Beginning last fall, we received a large number of phone calls and e-mails from dealers who wanted information about our 20-groups.

This was largely driven by the realization by these dealers that they needed to get a handle on their expenses and quickly. To do this, they needed input on industry benchmarks and the best practices that would help them achieve the proper results.

Additionally, many of the manufacturers have become more proactive about promoting 20-groups to their dealers. They see the importance of stabilizing their dealer networks by improving dealer profitability.

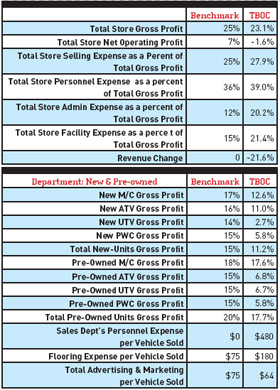

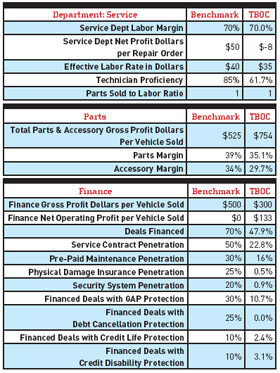

During the first four months of this year, dealers were reporting retail unit sales declines in the 40 to 60 percent range. January saw 56 percent of dealers up in total store gross profit, despite steep unit sales declines. Nearly, all showed a negative net operating profit for January for the last 2 years, and 50 percent were below 2008 numbers.

CY: current year

PVS: per vehicle sold

TBOC: average of the top five BOC members in this category

* Some rows and columns without data have been removed to reduce table sizes.

In February, 72 percent showed increased gross profits. However, most were again showing negative net operating profit for ‘ 08 and ‘ 09. Almost 60 percent were below 2008 numbers.

Click to Enlarge

In March, 60 percent of the dealers showed an increase in gross profit. In a small turn-around, 17 percent were showing a positive net operating profit; however, 72 percent were lower than 2008.

In April dealers reported more floor traffic and a relative increase in sales, although most were still well behind last year: 78 percent of the dealers tracked showed increased gross profits for April; 20 percent showed positive net profits; 56 percent reported a lower net operating profit than last year.

So what does all this mean? Obviously, unit sales have been down compared to last year—this is no surprise. Gross profits have been up while net has been down. Why is this? Primarily, as the sales of lower-margin products (major units) have decreased, the sales of higher-margin products have risen (P&A). So why have the dealers not increased net profits? The culprit here is expenses. Fixed expenses are now eating up a larger share of the dollars. In addition, dealers are ramping up staff anticipating the selling season. Although nearly all dealers are running with decreased employees compared with past years, they are still reluctant to lay off more good people that may be needed if it breaks loose.

The accompanying charts show April’s top BOC (TBOC) numbers for BOC group 1 compared with the benchmarks. Keep in mind that the TBOC only represents the averages of the top five members of this one group (based on total store gross profit)

On a good note, there is a positive trend of improving profits as we progress into the 2009 season. All indicators show a slow but steady growth of sales. This should continue, barring any more major economic hiccups. This is supported by the slow growth of the stock market, which is considered a precursor to the overall economic condition. Many analysts say the stock market will return about six months before we see a major economic turnaround.

Elevating Your Sales Game Through Parts Packaging

Breaking down the art and science of a well-designed, customer-focused, profit-friendly parts package.

Good parts managers are a rare breed. We are among the few who enjoy flipping through paper catalogs and covering them with notes. We love seeing how other companies merchandise shelves. We are always absorbing different sales techniques and wondering if we could use them too.

In that vein, when it comes to continuing to boost our numbers post-COVID, I have a few strategies for you to try. It might sound odd, but not everyone can remember that most winches need a winch mount. Or that certain winches require a hidden harness stored at the bottom of a book (hello, Can-Am). Or that Honda has split its winch harness between the winch and the mount. If you don't want service techs to hate you, you need to order both part numbers or else face their wrath.

Unleash Your Experts: How to Be a Long-Tail Resource for Powersports Enthusiasts

Closing deals and providing service are a dealer’s bread and butter, but your dealership has far more to offer.

Building a Growth Stategy With a Powersports Playbook

Success isn’t a fluke, and it’s not luck. It’s a strategy.

Fostering an F&I Culture That Sells

Dealership success hinges on the ability to cultivate a strong F&I culture.

Increasing Profits Through Accessorizing

Go out and find the units to dress up — there’s lots of extra profit to be made.

Other Posts

AJ Meisel Creates Community at Plano Kawasaki Suzuki

AJ has learned a thing or two over her 30-year powersports career.

Q&A: Powersports Consumer Sentiment Forecast for 2024

Consumers aren’t delaying purchases because of the economy, but they’re still looking for deals.

Nothing But Good Vibes at Santa Barbara Motorsports

Santa Barbara Motorsports is working to make every door swing count.

To E-Bike or Not to E-Bike?

When it comes to e-bikes, it’s the wild, wild West out there.