Last month, we looked at March numbers and explored market trend information from our dealer survey. This month, we’ll see how year-to-date April 2010 stacks up compared with 2009.

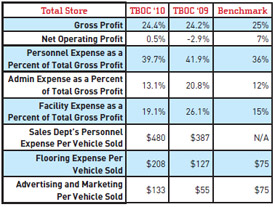

Chart 1 represents data averages compiled from top-performing members in selected groups.

Chart 1

As we saw in March, the numbers are still improving when compared with ’09. Although small, the net is a positive number.

Personnel expense is much lower than it has been. Dealers are really struggling with this. You can only reduce staff so far before it negatively impacts your customer service and results in lost sales. Administrative expenses are within reach of the 12 percent benchmark, and facility expenses are coming down as dealers find new ways to cut overhead.

The sales department’s personnel expense per vehicle sold has gone up. This is partly due to dealers ramping up sales staff for the selling season. It should level out if sales continue to rise. In these groups, there has been a rise in the flooring expense per vehicle sold, despite the reduction in inventory. Spring advertising, driven by the need to move the floored inventory, has increased the advertising and marketing dollars per vehicle sold.

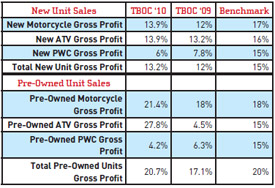

Chart 2 shows new and pre-owned unit margins improving significantly, with the exception of watercraft. Overall pre-owned margins are very strong. I urge you to grow this part of your business. It plays an important role in expanding your customer base and improving your dealership’s profitability.

Chart 2

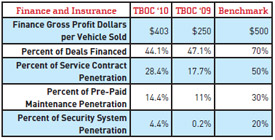

Overall, the F&I numbers in Chart 3 are showing a significant improvement. Could you use an extra $153 gross profit per vehicle sold? There are significant increases in service contract sales, pre-paid maintenance and security systems. A number of these dealers have hired better F&I producers and/or provided the staff with proper training.

Chart 3

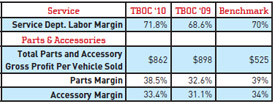

Chart 4 reveals continued improvement in service labor margin. Parts and accessories margins are back up after falling off last year. Parts and accessories gross profit per vehicle sold is decreasing as unit volume rises. This is to be expected.

Chart 4

Continue to monitor your numbers closely. Get them in line with or better than industry standards. Build those customer relationships for life by providing the best customer service possible. Provide high-quality training for your staff whenever you can. This will help you survive the ups and downs of our business.

At GSA we track benchmarks through our involvement with dealer 20-groups. The TBOC data comes from the groups that are in the a real-time, web-based data reporting system. National Norms are compiled from the groups that report in the former-RPM data system.

Maximize Every Sale With F&I and PG&A

This recorded AIMExpo education track discusses how the bike is just the start of the sale.

At AIMExpo 2024, Greg Jones, content director for MPN, moderated the finance and insurance (F&I) panel in MPN's Dealer Excellence education track. The panel consisted of Jason Duncan, McGraw Powersports; JD Baker, Protective Asset Protection; John McFarland, Lightspeed; and Zachary Materne, Apiar Commercial Risk Management.

In this session, Jones and the panel discuss how to maximize every sale beyond the bike with F&I and parts, gear and accessories (PG&A). The panel advises on best practices, how to make the purchase process more exciting, how to utilize technology in this process and more.

Elevating Your Sales Game Through Parts Packaging

Breaking down the art and science of a well-designed, customer-focused, profit-friendly parts package.

Unleash Your Experts: How to Be a Long-Tail Resource for Powersports Enthusiasts

Closing deals and providing service are a dealer’s bread and butter, but your dealership has far more to offer.

Building a Growth Stategy With a Powersports Playbook

Success isn’t a fluke, and it’s not luck. It’s a strategy.

Fostering an F&I Culture That Sells

Dealership success hinges on the ability to cultivate a strong F&I culture.

Other Posts

Increasing Profits Through Accessorizing

Go out and find the units to dress up — there’s lots of extra profit to be made.

AJ Meisel Creates Community at Plano Kawasaki Suzuki

AJ has learned a thing or two over her 30-year powersports career.

Q&A: Powersports Consumer Sentiment Forecast for 2024

Consumers aren’t delaying purchases because of the economy, but they’re still looking for deals.

Nothing But Good Vibes at Santa Barbara Motorsports

Santa Barbara Motorsports is working to make every door swing count.