While pre-owned powersports unit sales continue to be a shining star for dealers, the wholesale market has crested its peak. Dealers are still in their selling season and need good inventory from the auction, but they are maintaining their inventory levels rather than building up in anticipation. This is typical for May as the market coasts into the summer months.

On-Road Buyers More Selective

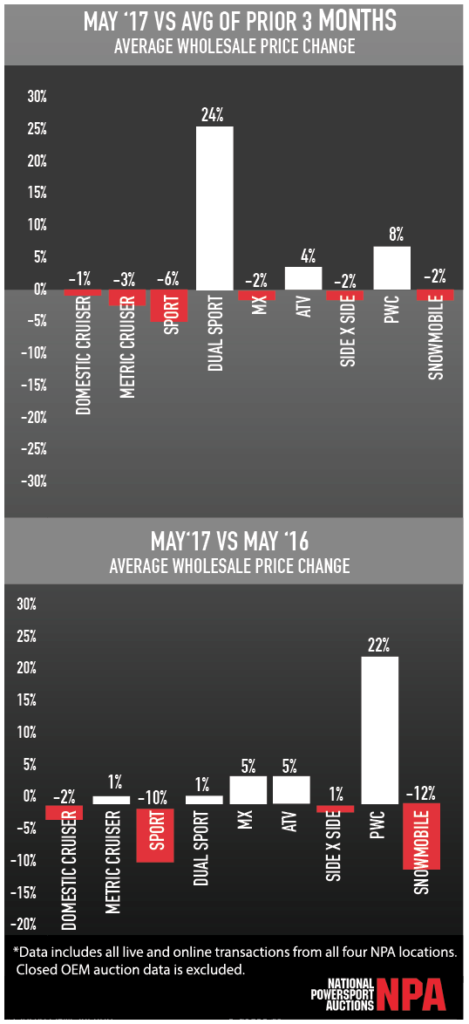

Compared to April, on-road prices in May trended down, which was driven largely by buyers paying less for higher-mileage, lower-condition units than during the peak. There were also more older, higher-mileage units in the mix. Off-Road prices rose slightly from last month, a reflection of both continued demand vs supply and a higher-MSRP product mix. Average prices for cruisers and sportbikes declined in May from the prior 3-month average by 3% and 6% respectively, and were roughly flat for cruisers (+-2%) and down for sportbikes (-10%) over last year. Off-road prices were up ~2-5% over both the prior 3-month average and prior year, indicating there was still gas left in the tank for off-road.

Price/Book Remains Strong

For May compared to the prior month, average wholesale prices vs NADA clean wholesale also declined for on-road vehicles and rose for off-road. When both the average prices at auction and price/book ratios move the same direction, it is usually a sign of market conditions rather than product mix, supporting the notion that the spring market is moving past its peak. Meanwhile, price/book ratios are outpacing both last year and the prior 5-year average for almost every product category, so despite moving past the spring peak the wholesale market is still vibrant for pre-owned powersport units.

Through The Looking Glass

Watching 2017 unfold is somewhat like looking in the mirror at 2016. The primary difference is that prices are stronger in 2017 due to a healthy retail market for pre-owned. If we could look through the mirror and see what lies ahead, we think we’d see the trend continue – 2017 should continue to mirror 2016 at slightly elevated prices and a softer transition into summer, off-road will remain strong and happy consumers will ride away as new motorcycle enthusiasts.

All data provided by National Powersport Auctions. For more information, please visit www.npauctions.com.