At GSA, we track benchmarks through our involvement with dealer groups such as the Best Operators Club. Some of the members have kindly consented to let us share their numbers from our real-time, web-based data reporting system.

In this column, we’re going to review the July P&A numbers for one of our member dealers and the related TBOC averages.

YTD, this dealer sold a total of 2,045 new and used motorcycle, ATV, UTV, scooter and PWC units. Last YTD, he sold a total of 2,449, so overall sales are down. Sadly, we are seeing this as the norm for the majority of dealers across the country. This is obviously a larger dealer. He is located in a metro market of more than 600,000 people.

While we review various sizes of dealers in these articles, I want to reinforce the fact that the PVS and margin numbers we will examine should be similar for any dealer, regardless of size or location. They represent a dealer that is controlling expenses and working hard to maximize add-on sales and hold margins.

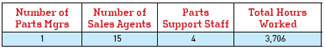

In Chart 1 you can see some of the numbers that we track in our Voyager data system. We see that his P&A department operates with one manager, 15 salespeople and four support staff. We also monitor inventory valuation, obsolescence and tire and battery sales (as parts department traffic and sales indicators).

Chart 1

CY: current year

PVS: per vehicle sold

TBOC: average of the top five BOC members in this category

* Some rows and columns without data have been removed to reduce table sizes.

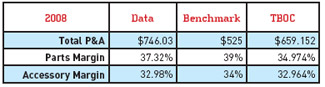

In Chart 2 we see his margins are slightly below the benchmarks. He is ahead of the TBOC in parts margins and about even in accessories. The accessories benchmarks were quite a bit higher in the past. These have been eroded, largely by Internet competition.

What makes this dealer an interesting example is that he has raised his P&A gross profit dollars PVS from $609 in 2007 to almost $750 in 2008. This is a significant increase that really contributes to the store’s bottom line. He is well beyond the $525 benchmark, which is also being bested by the TBOC. This is an indicator that the benchmark has become too low and will have to be revised upward at the next group meeting.

Chart 2

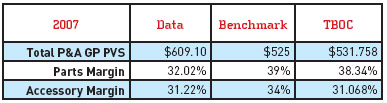

How did they accomplish this increase in GP dollars PVS? Well, you could simply attribute it to the reduction in unit sales combined with maintaining P&A revenue. You could, but that wouldn’t be the answer. When we look at Chart 3, we see that they have increased their margins, particularly in parts. They accomplished this by reducing the discounting at the counter and building the value of their staff and products to support their pricing. This dealership’s parts department strives to achieve exceptional customer service and follow-up. They work hard to maximize add-on sales at the counter and over the phone. They have periodic P&A events and promotions to attract new customers.

They also follow best practices like a customer path process. Once the unit is sold, the customers are introduced to P&A specialists who help them select proper riding gear, accessories and maintenance products. Surprisingly, surveys have proven that customers who purchase more P&A at the time of the unit purchase return higher CSI scores — they are happier because they bought more!

Seriously, customers are happier when they go home with the right gear, maintenance products and accessories to do what they bought the unit to do: enjoy the ride.

Chart 3

Industry Veterans Marilyn Stemp and Steve Piehl Appointed to Sturgis Motorcycle Museum and Hall of Fame’s Board

Stemp and Piehl will begin serving on the board immediately.

The Sturgis Motorcycle Museum and Hall of Fame recently named Marilyn Stemp and Steve Piehl to its board of directors.

Stemp is a pioneering figure in the motorcycle industry, founding IronWorks Magazine with her late husband, Dennis, and becoming the first female editor of a nationally circulated, mainstream motorcycle magazine. She also revived their trade magazine, Iron Trader News; edits the monthly Kiwi Indian News; contributes to several powersports media outlets; and is the founding editor of Sturgis Rider Daily. Stemp is a noted editor and writer of several motorcycle-focused books. Her consistent support for charitable efforts in the industry include the annual Biker Belles Celebration, Las Vegas BikeFest and as campaign chair for the Sturgis Motorcycle Museum’s development plan in 2014. She co-founded the Flying Piston charity events taking place in Daytona and Sturgis each year and is a National Ambassador for All Kids Bike. Stemp was inducted into both the Las Vegas Motorcycle Hall of Fame and the Sturgis Museum's Hall of Fame in 2018, and in 2022 she was recognized as one of the Top 100 Women in Powersports by DealerNews.

MIC Statistical Annual Now Available

Get ahead of the motorcycle sales season.

REV’IT! TAILORTECH Design Challenge Offers U.S. Riders Chance to Win Custom Race Suit

Submissions will be accepted through April 21, 2024.

Vespa World Days 2024 Set to Run April 18-21

The National Vespa Clubs from 55 countries come together, uniting thousands of Vespas from five continents.

Mips Becomes Official Safety Partner of the FIM Motocross World Championship

This exclusive collaboration promotes enhanced safety awareness across the MXGP series.

Other Posts

Rekluse Team Names Randy Mullinix Product Manager

Mullinix comes with a tenure of two decades at leading OEMs.

Indian Motorcycle Announces Sponsorship of Handbuilt Motorcycle Show

Indian’s sponsorship includes the season’s first Owners Ride, Custom Bike Display and demo rides of the all-new Scout lineup.

Iron Pony Motorsports Acquires Honda/Suzuki/Can-Am of Jackson

The company expands its footprint in Ohio.

MAP Services Corp. Adds 13 New Brands to Portfolio of Clients

MAP Services leverages AI to enforce MAP policy and monitor compliance.