Off-Road Up, On-Road Slowing Down

As temperatures start to cool down, the off-road category in the wholesale powersports market is heating up. With hunting and desert seasons quickly approaching, the off-road segment is experiencing continued demand.

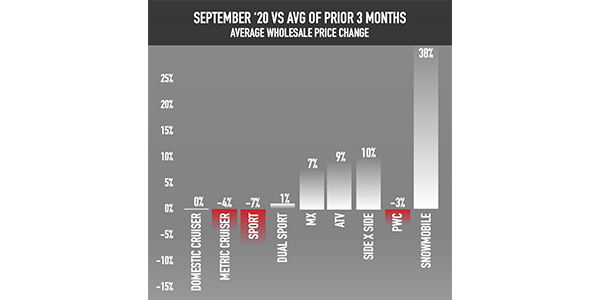

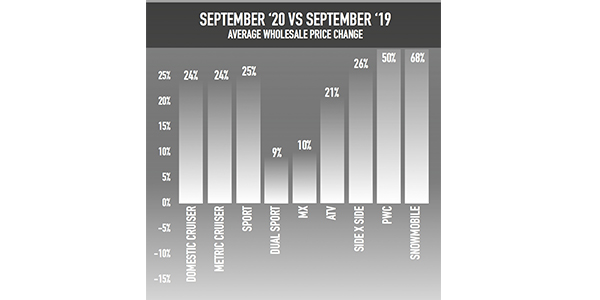

Compared to three-month Average Wholesale Prices (AWP), the off-road categories have increased across the board, most notably a +9% and +10% increase in ATVs and side-by-sides. Off-road prices are also up Year over Year (YoY) and are at five-year highs in seasonal AWP.

As off-road rises, on-road categories have started to slow as we near the winter months. All major on-highway categories are flat or down vs. their three-month average AWP, which is expected this time of year. When comparing September’s AWP for on-road categories YoY, we see all categories are still up double digits over last year.

Model Ages Varied

Off-road’s average model age dropped more than one year in September. This was a major influence in off-road’s rise in AWP for September. Unlike the off-road category, the on-road categories average model age was mixed. Overall vehicle condition scores did not fluctuate much for most categories, but they have been declining in the sport and dual sport categories.

Q4 Predictions

As we enter the typically slower months of the powersports season, the pandemic-related increases in buyer demand and first-time riders are keeping values higher than usual. We expect on-highway vehicle AWP to gradually decline through the end of the year, while off-road will remain solid.

Inventory management will be key to pre-owned success this holiday season. With limited supply, stocking the right inventory and managing days in inventory will result in a more profitable winter.

Link: NPA