Marketing your dealership is an important part of staying ahead and remaining profitable. Many dealers have improved significantly by increasing their marketing efforts.

Marketing your dealership is an important part of staying ahead and remaining profitable. Many dealers have improved significantly by increasing their marketing efforts.

Chart 1 is a snapshot of some key performance indicators for the overall store. These are provided to you each month as a point-of-reference for the department numbers.

The group members have made a significant improvement in their overall store margin, albeit still short of the 25 percent target. It takes a huge effort to move this number by 1 percent, let alone 3.4 percent — they are to be commended. The national norms came up over a full point as well. This is a good trend.

The service department’s contribution to gross profit also came up a point for the group members and above 1.5 percent for the Top 5 dealers while the NN was nearly unchanged. We’d like to see 18 percent or more in this column.

While door swings stayed flat for the group, the Top 5 and NN dealers brought in more traffic. Do you suppose the cost per door swing could have something to do with this? It is necessary to continue marketing constantly. There has been a tremendous increase in the variety of media exposure to all forms of advertising. Because of this, it takes nearly double the number of impressions to get a response from today’s consumer as it did 10 years ago.

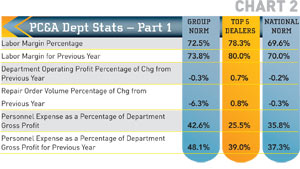

Chart 2 shows that labor margins have been right on the 70 percent benchmark for most of the year, even though most non-snowmobile dealers are into their slower service periods. The Top 5 dealers are still holding strong 78 percent margins. This means that they are holding tech compensation around 22 percent of revenue. This does not mean they underpay techs; it means they have highly productive operations. They also have appropriate labor rates and take the time to build value to justify their labor prices.

Chart 2 shows that labor margins have been right on the 70 percent benchmark for most of the year, even though most non-snowmobile dealers are into their slower service periods. The Top 5 dealers are still holding strong 78 percent margins. This means that they are holding tech compensation around 22 percent of revenue. This does not mean they underpay techs; it means they have highly productive operations. They also have appropriate labor rates and take the time to build value to justify their labor prices.

Operating profit has changed very little. However, the profit margin is so tight that it takes a great deal of effort to bring it up by almost a full point as the Top 5 dealers did.

Personnel are one of the major department expenses. All of these dealers have reduced this number as a percent of department gross profit, but the Top 5 have managed to bring this down by more than 10 percent! Personnel expenses for this department would be anyone other than technicians — this includes the service manager, service writers, lot porters and “hydro techs” (wash guys).

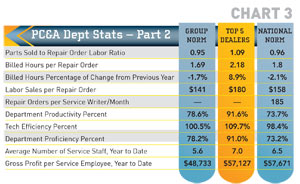

Chart 3 shows that parts-to-labor ratio is right in line with the 1:1 goal for all dealers. Billed hours are not so hot for the group — well below the two-hour target. The Top 5 are right there with 2.18, and up from last year as well.

Chart 3 shows that parts-to-labor ratio is right in line with the 1:1 goal for all dealers. Billed hours are not so hot for the group — well below the two-hour target. The Top 5 are right there with 2.18, and up from last year as well.

This particular group and its Top 5 are not reporting repair orders per month in this system, but the NN dealers are running at 185. This is acceptable — barely. When service writers get more than 175 repair orders per month, their hours per repair order and P&A sales per repair order start to fall. Why? Because they don’t have the time to do a proper walk-around and upsell presentation.

Productivity is good for the Top 5 dealers because they run tight operations with multiple lifts and pre-staging. They work to maximize every minute that a tech is at work. I know I’m a broken record, but we have to look at this as a dollars-per-minute operation and do all we can to keep techs turning wrenches if we want to make it profitable.

The gross profit per service employee is really close for the Top 5 in this group and the NN dealers. Through November, they are both producing almost $10K more than the group average. Where is your service department in relation to this?

Have questions? Feel free to contact me for information, explanations or to discuss how GSA can help you grow your business profitably at [email protected] or visit www.gartsutton.com.

Steve Jones, GSA senior projects manager, outlines dealerships’ best business practices to boost margins, increase profitability and retain employees. His monthly column recaps critical measurements used by the leading 20-group dealers. Access to the new Voyager 5 data reporting and analysis system is available to any dealership for nominal fee. For more information on GSA’s management workshops, data reporting system, dealer 20-groups, on-site consulting or training, visit www.gartsutton.com.