A summer review of average wholesale prices

As we dive deeper into the summer season the powersports market has officially transitioned into its seasonal adjustment in Average Wholesale Prices (AWP). The first two weeks of July started out with wholesale pricing better than we expected, then declined on average in the remaining weeks as dealers continued to right-size inventory and OEM retail incentives started to kick in. Softer pricing is very common this time of year and adjustments remain inside these seasonal norms.

As we dive deeper into the summer season the powersports market has officially transitioned into its seasonal adjustment in Average Wholesale Prices (AWP). The first two weeks of July started out with wholesale pricing better than we expected, then declined on average in the remaining weeks as dealers continued to right-size inventory and OEM retail incentives started to kick in. Softer pricing is very common this time of year and adjustments remain inside these seasonal norms.

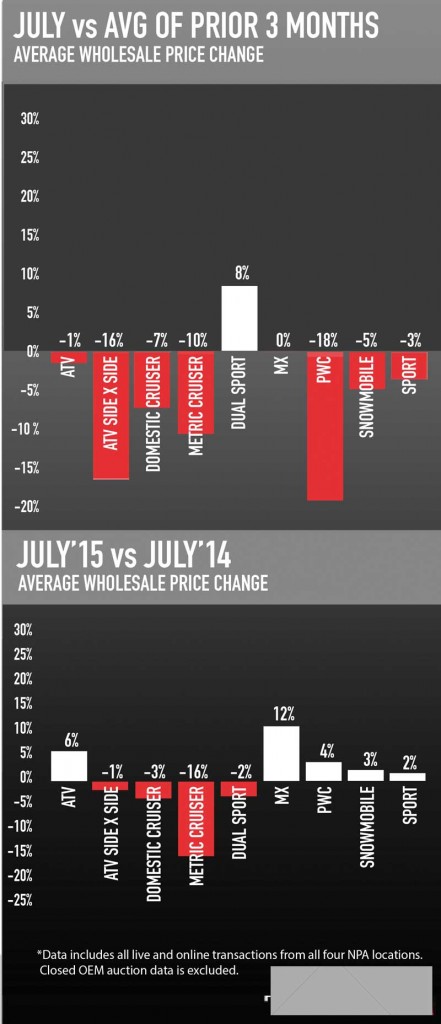

Street categories had the largest shift in wholesale pricing through July, falling 3-9 percent over the prior three month average and approximately 6 percent on average from last year. Alongside the seasonal shift in buyer demand we also saw a continued increase in vehicle age and mileage, which has an added downward affect on average wholesale price. Metric Cruisers took the biggest hit with a 9 percent decline in pricing compared to last year, while Sport bikes were up 2 percent from last year. Based off our five-year model, we expect this seasonal softness to continue into the fall.

The off-road market also shifted down in AWP, but was softer than street categories with average declines approximately two percent over the prior three months and up 6-10 percent compared to last year. The Side-x-Side category experienced a much larger impact with declines over both the prior quarter and prior year, but we believe this was primarily due to shifts in product mix and condition rather than an overall representation of the Side-x-Side market.

Powersports as a whole continues to strengthen. The increase in lower conditioned and higher mileage vehicles is a sign that dealers are able to move their cleaner, low mileage pre-owned units to retail customers. With the increase in near and sub-prime financing we are confident this trend will continue. Over the next couple of months we will see new models debuted from all the major OEMs and dealers will focus on ramping up for the new product. The result will be dealers getting aged or unwanted inventory off the showroom. With the additional supply of product the auction values will continue to rest on the seasonal trend line. If you have been looking for the right opportunity to purchase at auctions, the time is now!